Types of Employee Benefits: 17 Benefits HR Should Know

Richard Branson said: “Clients do not come first. Employees come first. If you take care of your employees, they will take care of the clients.” In other words, providing attractive employee benefits is an essential part of creating a positive employee and customer experience.

The types of employee benefits an organization provides carry weight in today’s employment market. Compensation on its own is not enough to engage employees and attract job seekers who now expect more comprehensive rewards for their work. HR practitioners need to be aware of the various benefit possibilities and determine which ones their organization should consider adopting.

Let’s have a look at common types of employee benefits, and examples of how companies are using them in their employee benefits strategy.

Contents

What are employee benefits?

Why are employee benefits important?

4 major categories of employee benefits

Types of employee benefits every HR practitioner should know

Employee benefits best practices

FAQs

What are employee benefits?

Employee benefits are an indirect form of compensation that organizations provide to their workers through programs, policies, or services. Typical examples include health insurance, paid time off, and life insurance.

Which benefits an organization offers will vary according to its business situation and location. Some employee benefits are country-specific. For instance, health insurance is a key component of employee benefits packages in the US. In France, many employees get restaurant vouchers for every workday.

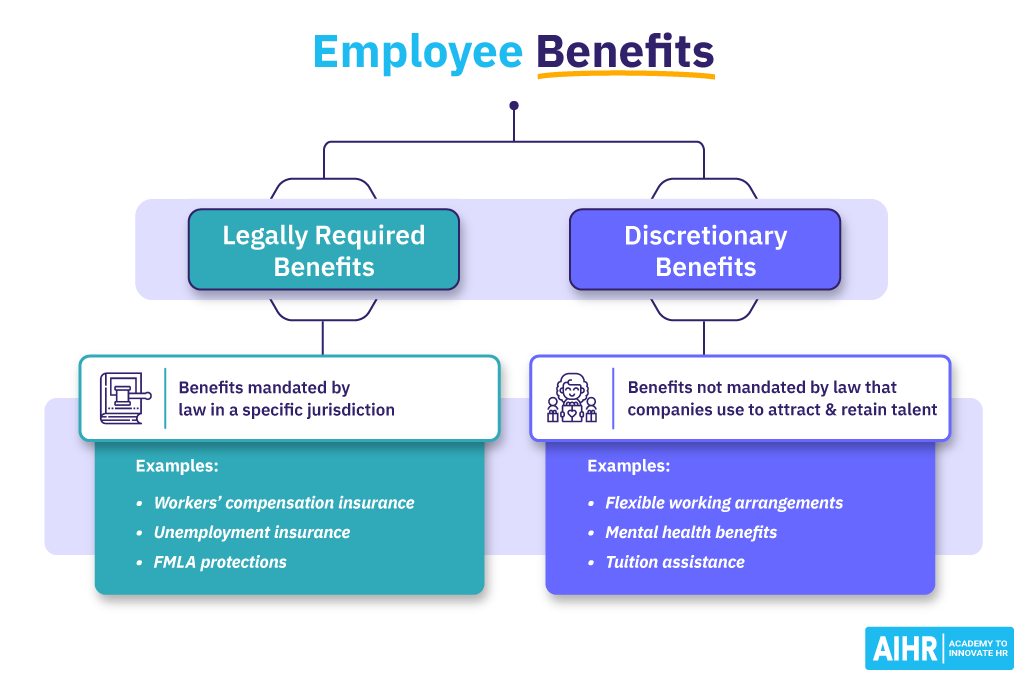

Depending on the country and region, certain benefits are mandated by law. Those that employers are legally required to provide are called statutory or legally required benefits. The ones that each employer chooses to supply are referred to as discretionary benefits.

Employee benefits are factored into total compensation and total rewards, so they play an important role in whether an employer meets employees’ and job candidates’ expectations.

In addition to benefits, most employers will provide perks. It’s common for perks and benefits to be viewed as the same, but there is a distinction between the two. While benefits are a form of compensation, perks are not factored into pay.

Perks serve as incentives or extra rewards that make an employer more appealing to work for. These can include enticements such as gym memberships, free lunch or snacks at work, or company-sponsored tickets to concerts and sporting events.

Find out about the four types of employee benefits you should know about in this Learning Bite!

Why are employee benefits important?

Most organizations will need to provide certain employee benefits to comply with legal regulations, but offering the bare minimum is not enough. When employers have a strong employee benefits package, it translates into the following advantages:

- Attracting talent: While two jobs may have the same salary, they can vary greatly benefit-wise. Your benefits package can make your organization stand out as an employer. For example, 88% of job seekers consider health, dental, and vision insurance benefits, as well as flexible hours, in their job search. Candidates will weigh the value of benefits along with base salary to see which job puts them in the best financial position.

- Improving employee retention: Employee benefit offerings vary with each organization, and some will suit workers’ needs better than others. When their needs are met, employees are more likely to remain with the employer. As a result, companies rated highly on compensation and benefits experience 56% lower employee turnover.

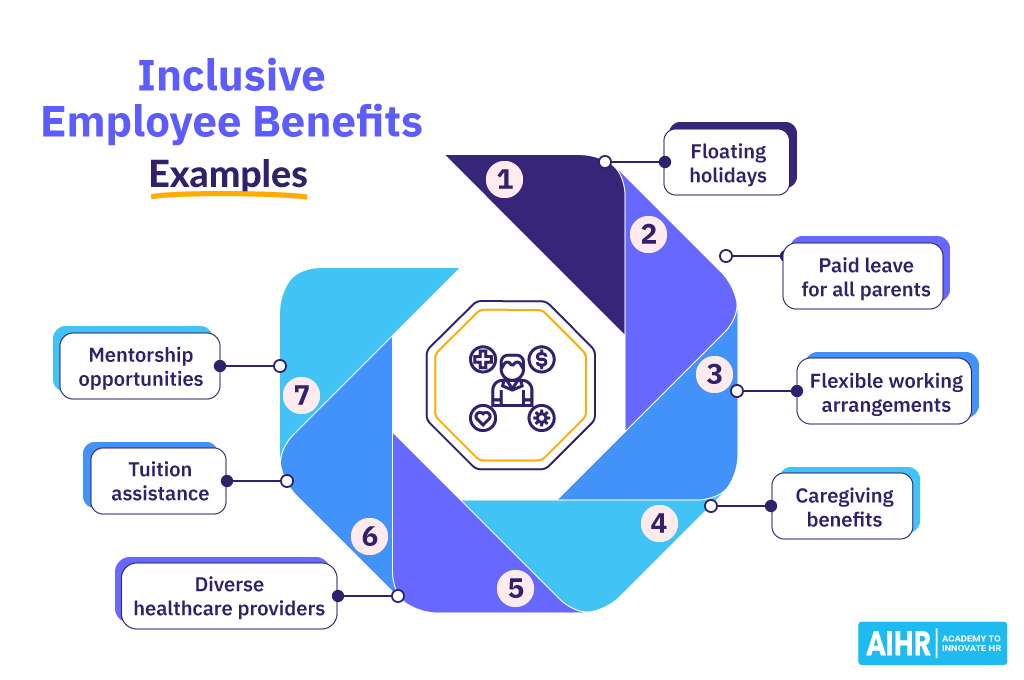

- Fostering inclusion at work: The right selection of benefits can help you promote inclusion in the workplace by showcasing your dedication to catering to the different needs and circumstances of your employees. Some examples of inclusive benefits are parental leave for all parents, floating holidays, domestic partner benefits, and flexible scheduling.

- Promoting a healthy workforce: Many employee benefits support health and well-being. Access to medical care and wellness or enrichment programs helps employees take better care of themselves. Healthy, happy employees are more productive and less likely to miss work.

- Increasing employee satisfaction and loyalty: Benefits are an investment in employees. When people believe their employer values and appreciates them, they experience more fulfillment. Employees who are content with their benefits are 70% more likely to be loyal to their employer. They’re also two times more likely to be satisfied with their jobs, enhancing overall employee experience.

4 major categories of employee benefits

Traditionally, employee benefits included medical insurance, life insurance, retirement plans, and disability insurance. These were usually mandated. For instance, many countries require that employers provide some type of medical insurance. However, employee benefit offerings of today have expanded well beyond this scope.

There are various employee benefits examples that we’ll be looking at below, but the four major categories are as follows:

- Insurance: This category includes all types of health insurance (medical, dental, vision), as well as life insurance and disability insurance. Health insurance options help meet employees’ and their families’ ongoing needs, while life and disability insurance policies provide funds for occasional or permanent unforeseen circumstances.

- Retirement plans: Retirement benefits allow employees to earn employer contributions or save and invest some of their wages for the future. Opportunities to enroll in these plans and automatic payroll deductions support and simplify the process of preparing employees for retirement.

- Additional compensation: The opportunity to earn money beyond an employee’s regular salary can be made available through commissions, bonuses, and performance awards. Also included in this category is indirect compensation, such as profit-sharing and stock options.

- Time off: People need breaks from their regular work schedule, and competitive employers understand the worth of granting time off with pay. Holidays, sick leave, vacations, family leave, bereavement leave, and sabbaticals are all desirable to employees. Paid time off is even mandated in many countries. Employers that expand their policies on types of leave to go beyond the status quo or any legal requirements have an attractive benefit to tout.

Types of employee benefits every HR practitioner should know

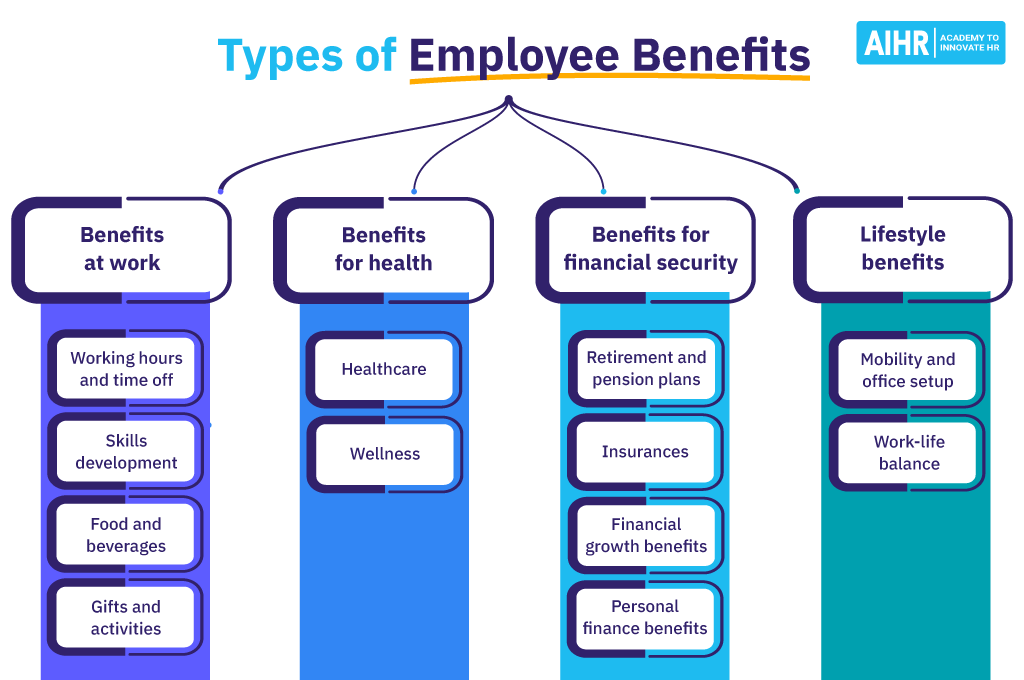

As the needs of employees are evolving, so are the types of benefits organizations offer. Global benefits and total rewards platform Benify distinguishes the following four types of employee benefits by their role in employees’ lives:

- Benefits at work

- Benefits for health

- Benefits for financial security

- Lifestyle benefits

Let’s take a closer look at each type and what benefits it includes. Beyond these four types, we will also discuss some unique employee benefits.

Benefits at work

Benefits at work relate directly to how employees experience their jobs and include working hours and time off, skills development, food and beverages, and gifts and activities.

Working hours and time off

Work schedules and situations are top considerations for most people. They want control over when and where they do their work. This became the norm when pandemic quarantines kept employees at home.

According to a study done by Qualtrics, “93% of employees say the way we work has ‘fundamentally and forever’ changed” with the most favorable changes being flexible schedules, remote work, and hybrid work.

If employees can work during times they feel most productive and have more control over their work-life balance, they will feel more job satisfaction. Favorable options such as flexible work schedules and remote/hybrid arrangements are now expected. In fact, 49% of Millennial and Gen Z workers would consider quitting their jobs if there wasn’t some consideration for remote work.

Another important factor for people is when they don’t have to work. Vacation, holidays, sick leave, parental leave, and various other types of leave policies are scrutinized by employees and job seekers. Unlimited paid time off is an emerging concept that’s gaining traction with innovative employers.

“People are looking for paid time off (PTO) policies that support work-life integration, and companies who encourage employees to take their PTO and don’t expect employees to “be on” while on vacation or taking sick time. PTO is a company benefit, and employers who treat PTO as a time for employees to completely disconnect while out of the office have a competitive edge,” notes Eric Mochnacz, Senior HR Consultant at Red Clover HR.

Skills development

Rapid technological developments make employees aware of how important skills development is. The University of Phoenix’s Career Optimism Index® discovered that 52% of American workers believe they are replaceable in their positions, and 68% say that more opportunities to upskill would keep them with their current employer.

Many workers look for employers that will support their continuing education endeavors. Benefits such as tuition funding, student loan assistance, or a budget for professional training and certifications do just that.

Food and beverages

While in the US, food would be considered a perk, it’s a common employee benefit in several European countries, including France, as we’ve mentioned above, and Germany.

In general, providing food at work is a crowd-pleaser. Everyone requires sustenance during the workday, so having it readily available is very appealing. One survey showed that 67% of full-time employees who have free food at work are “extremely” or “very” happy with their job.

Providing coffee, soft drinks, snacks, or meals at little or no cost sets an employer apart from those that don’t.

For example, AIHR employs a chef who prepares and serves free lunch every day for employees. Robinhood, a stock trading and cryptocurrency investing app, promotes a fully stocked kitchen and catered meals to job seekers on its career page.

Gifts and activities

While fun activities and gifts are also perks rather than benefits, they’re worth considering including in your total rewards strategy. These added incentives boost morale and make employees feel valued. Employee appreciation gatherings or outings, company swag, achievement awards, and birthday or work anniversary gifts all contribute to a positive work environment.

Online retailer Zappos’ employees are recognized with “Zollars.” They can spend this currency on Zappos branded items or movie tickets or use them to make a charitable donation.

Benefits for health

Benefits for health support employees’ overall well-being at or outside of work. These include healthcare and wellness.

Healthcare

Medical, dental, and vision insurance plans are traditional healthcare benefits. Some companies will supplement these with other specialized services such as physiotherapy and chiropractic sessions, fertility treatments, or psychological support.

One tech company has taken this a step further. Employees located at Apple’s major campuses have access to onsite doctors, nurses, dieticians, and acupuncturists.

Wellness

Awareness of overall wellness has multiplied in the last few years. More and more employers understand that supporting employees’ well-being must go beyond medical care, and they have implemented programs to address this. Examples of employee wellness programs vary from a simple gym membership to full-suite solutions that include physical, mental, and financial wellness.

A focus on total employee well-being is one of the key HR trends for 2023. Looking ahead, leading HR departments will be looking for ways to improve the different aspects of their employees’ well-being.

Benefits for financial security

Benefits for financial security assist employees with present and future financial planning and preparing for economic challenges. These include retirement/pension plans, insurances, financial growth benefits, and personal finance benefits.

Retirement and pension plans

Saving and investing money for the future can be difficult. Many people would rather participate in an employer-sponsored retirement plan than try to do it on their own.

In the US, very few non-government organizations still offer a traditional pension plan. The 401(k) is now the most common employer-sponsored plan. It allows employees to invest a tax-free portion of their wages into the fund(s) of their choice. Employers will typically contribute to the employee’s account as well by matching a certain amount of their contribution.

Insurances

In addition to health insurance, there are other supplemental insurance benefits for employees to help them maintain financial stability despite adverse events.

Life insurance pays out funds to dependents if an employee passes away. Long-term and short-term disability insurance provides a percentage of wages to a worker who is sick or injured and unable to work for a brief period or indefinitely.

Financial growth benefits

The potential for making extra money appeals to employees. Commissions, bonuses, and performance awards motivate people to work harder. Stock options, stock ownership, and profit-sharing plans help bolster employees’ wealth.

Grocery chain Publix is employee-owned and consistently named one of the best companies to work for. Eligible associates are given some stock shares at no cost and have the opportunity to purchase more at certain points throughout the year.

Personal finance benefits

Feeling stress over personal finances is common. PwC’s Employee Financial Wellness Survey showed that over a third of full-time employees do not have more than $1,000 saved to pay for unplanned expenses.

Financial literacy programs with online tools and resources or consulting/coaching services for managing money and financial planning give employees the knowledge and advice they need to get themselves in a better financial situation.

You can also help employees overcome financial emergencies or being short on funds with earned wage access (EWA). These on-demand pay programs permit people to retrieve some of their earned wages prior to payday.

Lifestyle benefits

Lifestyle benefits offer employees support that makes their day-to-day life easier. These consist of mobility and work-life balance benefits.

Mobility and office setup

Mobility benefits simplify commuting or working from home.

Commuter benefits include company vehicles and subsidies for public transportation or carpooling. These types of commuter subsidies are common in the Netherlands.

Remote work allowances assist employees with the cost of running an office, such as equipment and internet. Buffer is a fully remote social media management software company. Its employees receive a laptop and $500 to set up their office, plus additional money for a co-working space.

Work-life balance

Employers that respect employees’ need to maintain their personal lives will cultivate a more positive employee-employer relationship. Offering extras like the following can help people achieve that longed-for work-life balance:

- Concierge services for grocery delivery, restaurant reservations, dry cleaning, event and travel planning, etc.

- Onsite childcare centers or subsidies to offset costs.

- Extended parental leave.

- Employee assistance programs (EAP) that provide confidential, professional support for resolving personal problems such as dependent care, legal issues, or relationship challenges.

Unique employee benefits

Organizations can differentiate themselves from their competitors and become highly desirable places to work by offering unique employee benefits. Here are a couple of examples:

Four-day workweek

Following the pandemic, the social media management software company Buffer trialed a four-day workweek for its whole team and has seen an increase in productivity and general wellbeing, which is why it’s here to stay. Some countries are also looking into the possibility of a four-day workweek. For example, workers in Belgium can now choose to complete their working hours in four days.

Fertility assistance

A study by Brabners found that 53% of employees with fertility problems would be more likely to stay with their employer if they funded infertility treatment. Athleticwear company Lululemon supports employees through fertility and reproductive benefits, including early deduction for prostate and testicular cancers, as well as endometriosis and PCOS support.

Pet insurance

51% of employees now list pet insurance among the top benefits that would impact their decision to take a new job. Currently, most organizations offer pet insurance as a voluntary benefit, but this is predicted to become a common offering with employers in the near future.

Family stipends

A family stipend, sometimes known as a family allowance, is an additional sum of money given to employees to help them pay for family-related expenses. For example, adoption fees, childcare, household supplies, groceries, travel costs, and more. The European Patent Office offers several types of family allowances to their employees, such as household allowance, childcare allowance, or education allowance.

Gainsharing and profit-sharing

Gainsharing and profit sharing aim to financially reward employees for better performance, which motivates them to do their best at work. ConvertKit places their profits into a pool that is divided between employees as part of their profit-sharing plan. Employees receive a bi-annual cash bonus.

Employee benefits best practices

Proper execution of employee benefit programs ensures that the investment being made pays off. Keep these five best practices in mind as you go:

- Collect employee feedback: Gather data from your employees via surveys and/or focus groups to understand how they feel about the types of employee benefits you offer. It’ll help you identify opportunities for improving your benefits packages to better address employees’ needs.

“Having insights into the demographic of your workforce helps businesses understand what benefits will have the greatest impact on your employees. They look at their benefits within the context of their total rewards package – whether they are looking to join your company or are current employees and are considering whether they want to stay or look for a new opportunity,” explains Eric Mochnacz from Red Clover HR.

- Work with inclusion in mind: Inclusive benefits contribute to internal and external equity. For example, 63% of large employers offer or are planning or considering offering inclusive family-building support to their employees. Organizations are also looking to address racial disparities in employee benefits.

- Improve benefits communication: Benefits awareness is often lacking. 69% of workers want to learn about the benefits their organization offers at least a few times throughout the year, but only 48% get that. On the other hand, 48% only receive benefits communication during open enrollment. Onboarding should include a clear explanation of all benefits. Then you should find ways to periodically convey what you offer to your employees, for instance, informative one-pagers, emails, and Q&A sessions.

- Enable personalization and ease of use: The needs of your employees differ. Enabling employees to customize their benefits will ensure they get the maximum value out of them. Also, make sure your system is user-friendly so employees can easily access information, forms, and the enrollment process.

- Measure the uptake: Track how your employees are using the benefits you offer while respecting privacy. In combination with employee feedback, you can, for example, get insights into whether employees are not using a particular benefit because they are not aware of it or because it’s not the right fit for them.

Wrapping up

The days of offering just health insurance and a pension plan as employee benefits are over. Today’s candidates and employees expect an array of benefits that support their health, well-being, financial security, and work-life balance. Being a competitive employer means making sure you choose the right types of employee benefits to best fit your workforce.

FAQs

Employee benefits cover the indirect pay of your workforce. This can be health insurance, sick leave, stock options, or many other methods of provision and assistance for employees.

Traditionally, most benefits used to fall under one of the four major types of employee benefits, namely: insurance, retirement plans, additional compensation, and time off. Global benefits and total rewards platform Benify distinguishes the following types: benefits at work, benefits for health, benefits for financial security, and lifestyle benefits.

Employers are legally required to provide certain benefits, depending on local, state, and federal laws. These are also referred to as statutory benefits. In the US, statutory benefits include unemployment insurance and FMLA protections. In the UK, all employers are required to provide full-time employees with 28 days of paid annual leave, auto-enrolment in an appropriate pension, statutory sick pay, and up to 52 weeks of maternity leave.

Benefits that employees value most include flexible hours, the opportunity to work from home, vacation time, and paid parental leave.

Employee benefits matter and can help organizations attract and retain talent, promote a healthy workforce, foster inclusion at work, and increase employee satisfaction and loyalty. A report by MetLife found that, if offered access to more benefits, 73% of employees would feel encouraged to stay longer with their current employer, while 55% note that health and wellness programs are necessary benefits to accept a new job offer.

Yes. The needs of your employees differ depending on their demographic, lifestyle, location, and personal values. Allowing your employees to tailor their benefits helps them get the most out of them, and helps the employer meet the needs of all its people. However, all your employees must be offered statutory benefits.

Weekly update

Stay up-to-date with the latest news, trends, and resources in HR

Learn more

Related articles

Are you ready for the future of HR?

Learn modern and relevant HR skills, online