Employee Financial Wellness – All You Need to Know

Financial wellness is a topic that increasingly pops up on the agenda of employers. With 69% of workers being stressed about their finances and 72% worrying about their personal finances at work, it’s not hard to see why.

As a result, a growing number of organizations are launching financial wellness programs for their employees to help them get their finances back on track. Research from the Bank of America shows that over half of employers (53%) in the US now offer said programs compared to only 24% in 2015.

In this article, we’ll take a good look at employee financial wellness; why does it matter, what is a financial wellness program, what does such a program look like, and what kind of financial wellness tools are out there?

Contents

What is financial wellness

Why financial wellness matters

What is a financial wellness program

Financial wellness program examples

Financial wellness tools

FAQ

What is financial wellness – A definition

Financial wellness (or financial wellbeing) refers to a person’s overall financial health and the absence of money-related stress. It’s the result of successful expense management.

Financial wellness is an important part of overall employee wellbeing which consists of physical, mental, and financial wellness.

Learn more about financial wellness in our Learning Bite video!

Why financial wellness matters

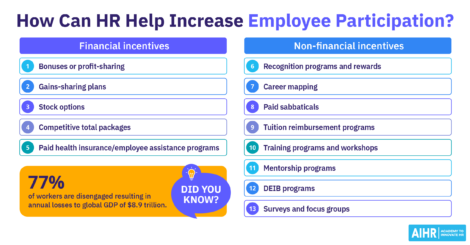

Unsurprisingly, financial stress has a negative impact on both the personal and professional lives of your employees – and by extension on your organization. We’ve listed some of the reasons why financial wellbeing is important below.

Presenteeism & Absenteeism

According to the Society for Human Resource Management, financial stress results in a 34% increase in absenteeism and tardiness. Employees who worry about money also miss almost twice as many days per year compared to their unstressed colleagues.

Money-related stress can also lead to an increase in presenteeism; employees coming to work despite being physically or mentally unwell. While it may seem less bad – people are physically present in the workplace after all – presenteeism seriously affects organizations and can cost them a lot of money.

Happy & healthier employees

Worrying about finances can result in a wide range of (serious) health issues for employees, varying from depression and anxiety all the way to ulcers and even heart problems.

In other words: if you can take your employees’ financial worries out of the equation, that’s one step closer to a healthier and happier workforce.

Apart from the fact that financial stress affects an individual employee’s health and morale, it will eventually also weigh on their team members and other colleagues.

Productivity loss

When you know that financial stress leads to an increase in absenteeism, presenteeism, and ill employees, it’s no real surprise that it also affects their productivity.

A survey done by Salary Finance among more than 10,000 Americans shows that US companies lose $500 billion a year due to their employees’ personal financial stress.

What is a financial wellness program

Employee financial wellness programs are programs that help employees (better) manage their finances and reduce financial worries. As such, they contribute to a better overall financial wellbeing for employees.

A financial wellness program is aimed at educating employees. This can be done in various ways varying from finance counseling and coaching on specific topics (such as reducing a student loan for instance) to the use of a platform that supports employees in managing their money. We’ll take a look at a couple of employee financial wellness program examples below.

Financial wellness program examples

Just like there are many different examples of employee wellness programs, there are also various examples of financial wellness programs. We’ve listed a selection below.

- Workshops. This is one you might not immediately think of since it’s such a simple way to educate your employees about their personal finances. It’s also a relatively low-cost (or sometimes even free) way to create a basic financial wellness program. How? Think of inviting regular guest speakers to run a workshop in the office on topics such as budget planning, reducing (student) debt, or savings tactics. Depending on the size of your company, you could also ask someone from your finance department to do a session.

- Dedicated partnerships. Another option is to establish a partnership with a company that specializes in employee financial planning. Depending on the budget you have at your disposal, you can, for example, go for a partnership that offers your employees services and expertise to help them better manage their money at a (significant) discount.

- Use financial wellness tools. Naturally, there are a lot of software solutions that aim to improve the financial health of employees. These solutions can provide anything from personalized coaching and on-demand financial advising to custom training and e-learning to improve your employees’ financial knowledge.

- Perks. Although I wouldn’t call this one an example of a financial wellbeing program, it can definitely be a part of it. As incredible as it may sound, some companies are offering their employees actual financial support. This can go from contributing to people’s student loan debt to offering fertility assistance or a contribution toward adoption.

Financial wellness tools

As we mentioned above, there are plenty of financial wellness tools out there. To give you an idea of the possibilities, we’ve highlighted four of them below.

LearnLux

LearnLux combines personalized digital education with on-demand financial advising. The company provides employees with learning materials and tools around topics like healthcare, benefits, taxes and emerging financial trends.

Your Money Line

Your Money Line prides itself on the fact that it provides practical and personal solutions to everyday money challenges. It offers employees a dedicated and confidential financial helpline that gives them access to a team of unbiased Financial Concierges. These latter are specialized in the day-to-day challenges that hinder many people’s financial lives.

Best Money Moves

Best Money Moves is a mobile-first financial wellness solution that combines technology, information, tools, and live money coaching to help employees measure their level of financial stress in 15 categories. After this ‘stress assessment,’ it sends them relevant information and tools to help them reduce that stress.

My Secure Advantage

My Secure Advantage wants to transform employee financial well-being through one-on-one money coaching by phone, budgeting software, on-site and web-based education, and website resources.

FAQ

Financial wellness (or financial wellbeing) refers to a person’s overall financial health and the absence of money-related stress. It’s the result of successful expense management.

The financial wellbeing of your employees matters because if they’re financially unwell, this will increase absenteeism and presenteeism, lead to more ill staff and lower their productivity.

Employee financial wellness program examples can be (in-person) workshops, dedicated partnerships with companies that specialize in financial planning, digital solutions, or a combination of these.

Weekly update

Stay up-to-date with the latest news, trends, and resources in HR

Learn more

Related articles

Are you ready for the future of HR?

Learn modern and relevant HR skills, online