23 Recruiting Metrics You Should Know [+ Free Template]

82% of companies believe that data is critical to drive talent acquisition decisions. This highlights that without tracking relevant recruiting metrics, your organization is potentially missing out on hiring top talent and risks staying behind the competition.

Recruiting metrics are an essential part of data-driven hiring and recruitment. However, if you would keep track of every recruiting metric you could find on the web, you’d have no time left to do actual recruiting! In this article, we’ll discuss the 23 recruiting metrics so that you can determine which ones are the most relevant for you and your business.

Contents

What are recruiting metrics?

1. Time to fill

2. Time to hire

3. Source of hire

4. Sourcing channel effectiveness

5. Sourcing channel cost

6. First-year attrition

7. Quality of hire

8. Hiring manager satisfaction

9. Candidate job satisfaction

10. Applicants per opening

11. Selection ratio

12. Cost per hire

13. Candidate experience

14. Offer acceptance rate

15. % of open positions

16. Application completion rate

17. Recruitment funnel effectiveness

18. Cost of getting to Optimum Productivity Level (OPL)

19. Time to productivity

20. Adverse impact

21. Recruiter performance metrics

22. Fill rate

23. Recruitment ROI

Recruiting metrics template

FAQ

What are recruiting metrics?

Recruiting metrics are measurements used to track hiring success and optimize the process of hiring candidates for an organization. When used correctly, these metrics help evaluate the recruiting process and whether the company is hiring the right people.

Additionally, recruiting metrics provide you with data that will allow you to make improvements to your recruitment process. They are an integral part of a data-driven recruitment funnel, which you can explore in-depth in our Sourcing & Recruitment Certificate Program.

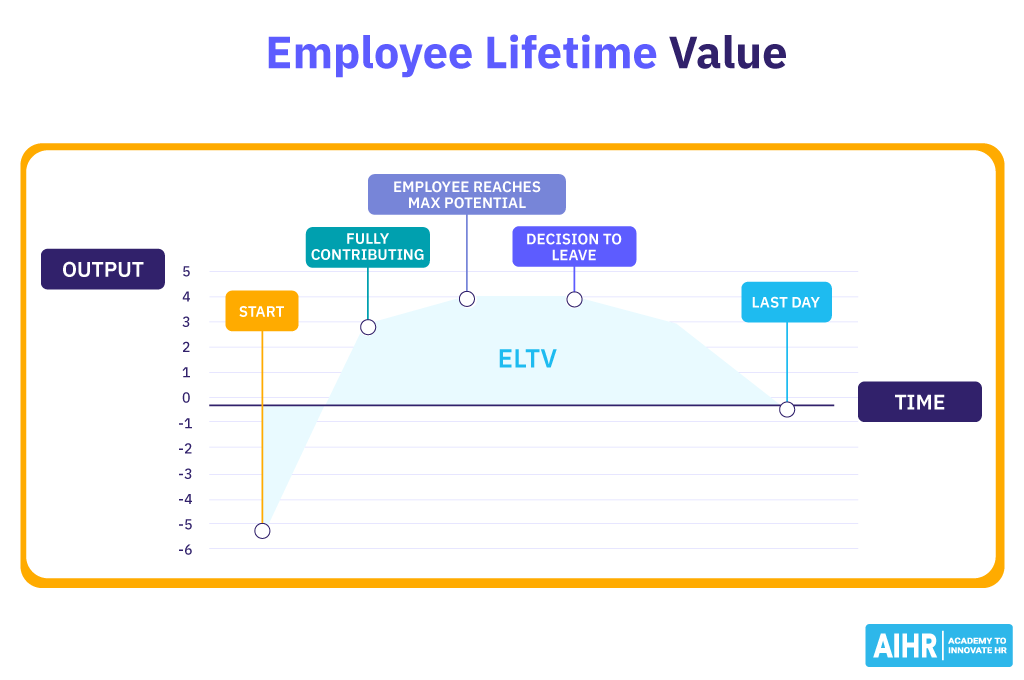

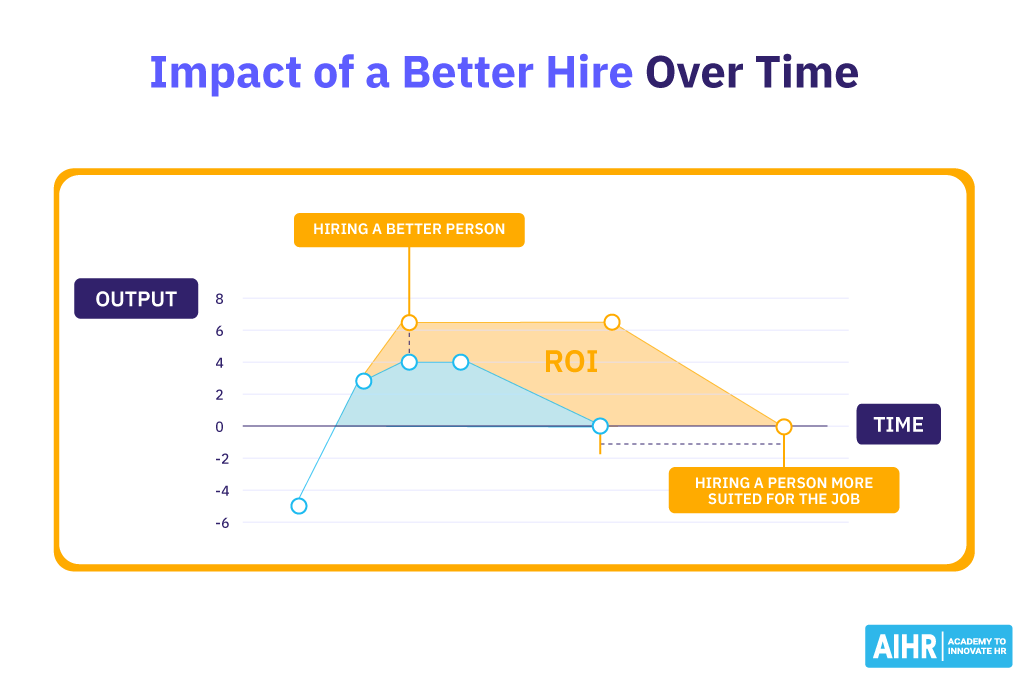

Making the right recruiting decisions is important. This image (based on Greenhouse’s image) shows the employee’s lifetime value as the sum of all the HR decisions made about that employee.

Using this image, we can see that hiring someone who is more suited for the job has the potential to create an enormous return on investment (ROI).

This is why recruiting the right people is so important. Whether you’re starting off by measuring recruitment data or fine-tuning your recruiting metrics, this list will give you a great overview.

Now that we’ve set the stage, let’s look at the 23 most relevant recruiting metrics.

1. Time to fill

Time to fill refers to the number of calendar days it takes to find and hire a new candidate, often measured by the number of days between approving a job requisition and the candidate accepting your offer. Several factors can influence time to fill, such as supply and demand ratios for specific jobs, as well as the speed at which the recruitment department operates.

It’s a great metric for business planning and offers a realistic view for the manager to assess the time it will take to attract and hire a replacement for a departing employee.

2. Time to hire

Time to hire represents the number of days between the moment a candidate applies or is approached and the moment the candidate accepts the job. In other words, it measures the time it takes for someone to move through the hiring process once they’ve applied. Time to hire thus provides a solid indication of how the recruitment team is performing. This metric is also called ‘Time to Accept’.

A shorter time to hire often enables you to hire better candidates, preventing the best candidates from being snatched up by a company that does have a short time to hire. It also impacts your candidate experience, as nobody likes a recruiting process that takes a long time. You’ll be able to see where the bottlenecks are in your hiring process, and you can work to remove them.

For example, the data might show you that there is a long time between resume screening and the phone interview. This can be an issue of scheduling, which recruiting teams can solve by implementing automated scheduling programs.

This metric is heavily influenced by your recruitment funnel. If you are hiring for jobs that have a relatively straightforward recruitment process of one interview, the time to hire will be shorter than when you have a phone intake, assessment day, and three rounds of interviews. For that reason, you should be a little bit careful when interpreting the time to hire benchmark we included below.

Time to hire Customer service Engineering Finance/Accounting IT/Design Sales Global average 21 29 25 27 24 U.S. & Canada 21 28 25 26 24 U.K. & Ireland 20 27 24 24 24 Europe 24 33 26 32 29

3. Source of hire

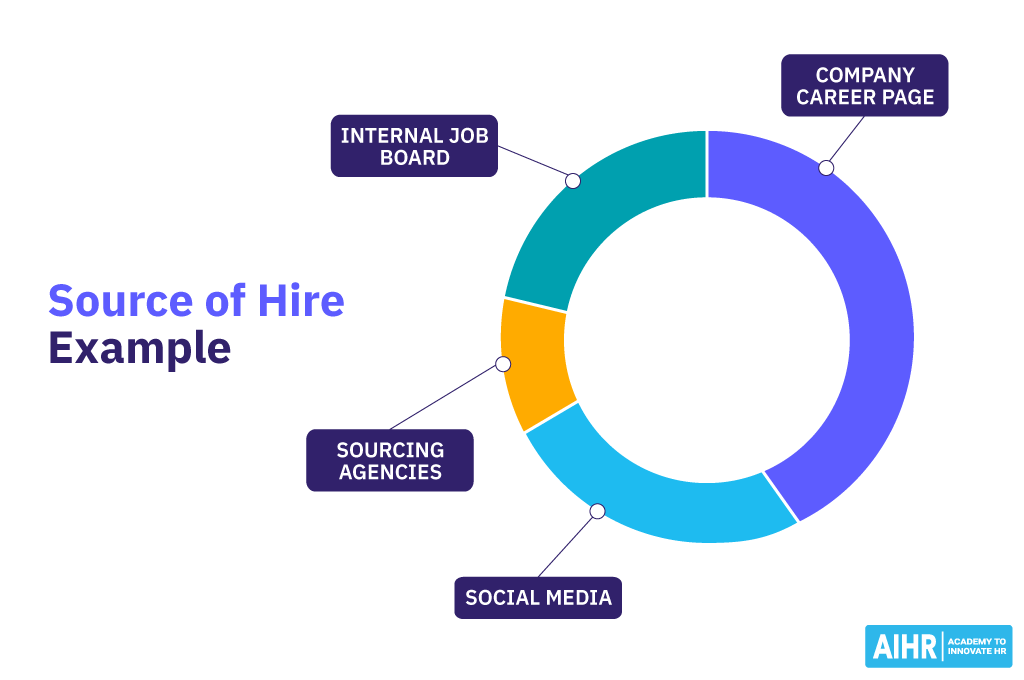

Tracking the sources that attract new hires to your organization is one of the most popular recruiting metrics. The source of hire metric also helps to keep track of the effectiveness of different recruiting channels. A few examples are job boards, the company’s career page, social media, and sourcing agencies.

Having a clear understanding of which channel works and which doesn’t, you’ll be able to double down on the channels that are bringing you the most ROI and decrease spending on those that aren’t. For example, if you see that most of your successful hires are not coming from sourcing agencies but from your company career page, then that’s the channel that you want to be focusing on.

4. Sourcing channel effectiveness

Sourcing channel effectiveness helps measure the number of potential candidates each of your recruitment channels is bringing in, and the conversion rate. By comparing the percentage of applications with the percentage of impressions of the job postings, you can quickly judge the effectiveness of different channels.

A simple way to do this is by using Google Analytics to track where the people who viewed the job opening on your website actually came from. Maybe the people coming from LinkedIn don’t apply, but the people coming in from Facebook do.

HR pro tip

Ask your colleagues from the Marketing department to help you set up and navigate Google Analytics for your careers page.

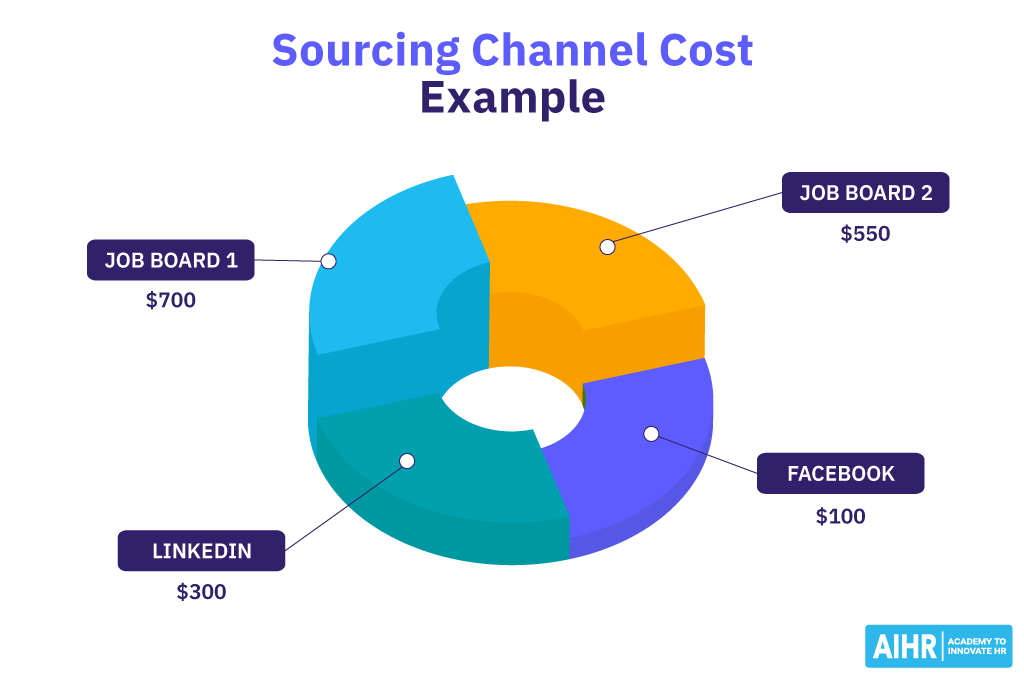

5. Sourcing channel cost

You can also calculate the cost efficiency of your different sourcing channels by including ad spend – the amount of money spent on advertisement – on those platforms. By dividing the ad spend by the number of visitors who successfully applied through the job opening, you measure the sourcing channel cost per hire.

Sourcing channel cost = Ad spend per platform / Number of successful applicants per platform

6. First-year attrition

First-year attrition or first-year new hire turnover is a key recruiting metric and also indicates hiring success. Candidates who leave in their first year of work fail to become fully productive and usually cost a lot of money.

There are two types of first-year attrition: managed and unmanaged.

Managed attrition means that the contract is terminated by the employer. Unmanaged attrition means that they leave on their own accord (this is also referred to as voluntary turnover). The former is often an indicator of poor first-year performance or bad fit with the team.

The second is often an indicator of unrealistic expectations, which cause the candidate to quit. This could be due to a mismatch between the job description and the actual job, or the job and/or company has been oversold by the recruiter.

This metric can also be turned around as ‘candidate retention rate’.

7. Quality of hire

Quality of hire, often measured by someone’s performance rating, gives an indicator of the first-year performance of a candidate. Candidates who receive high performance ratings are indicative of hiring success, while the opposite holds true for candidates with low performance ratings.

Low first-year performance ratings are indicative of bad hires. A single bad hire can cost a company tens of thousands of dollars in both direct and indirect costs. To read more about how to assess these costs, check out our article on HR costing.

When combined with the channel through which the candidate was sourced, you can measure sourcing channel effectiveness (see recruiting metric no. 4).

Quality of hire is one of the most common but also most complex recruiting metrics, as you can measure it in multiple ways. You can get an overview in our detailed guide.

Quality of hire is the input for the Success Ratio. The success ratio divides the number of hires who perform well by the total number of candidates hired. A high success ratio means that most of the hired candidates perform well. However, a low ratio means that you need to fine-tune your selection process.

Success ratio = Number of hired candidates considered satisfactory / Total number of candidates hired

The success ratio is used as input for recruitment utility analysis. This analysis enables you to calculate an ROI for different selection instruments.

8. Hiring manager satisfaction

In line with quality of hire, hiring manager satisfaction is another recruiting metric that is indicative of a successful recruiting process. When the hiring manager is satisfied with the new employees in their team, the candidate is likely to perform well and fit well in the team. In other words, the candidate is more likely to be a successful hire.

9. Candidate job satisfaction

Candidate job satisfaction is an excellent way to track whether the expectations set during the recruiting procedure match reality. A low candidate job satisfaction highlights mismanagement of expectations or incomplete job descriptions.

A low score can be better managed by providing a realistic job preview. This helps to present both the positive and negative aspects of the job to potential candidates, thus creating a more realistic view.

10. Applicants per opening

Applicants per job opening or applicants per hire gauges the job’s popularity. A large number of applicants could indicate a high demand for jobs in that particular area or a job description that’s too broad.

The number of applicants per opening is not necessarily an indicator of the number of qualified candidates. By narrowing the job description and including a number of ‘hard’ criteria, the number of applicants can be reduced without reducing the number of suitable candidates. You can also focus more on sourcing from channels that have brought qualified candidates in the past.

11. Selection ratio

The selection ratio refers to the number of hired candidates compared to the total number of candidates. This ratio is also called the Submittals to Hire Ratio.

Selection ratio = Number of hired candidates / Total number of candidates

The selection ratio is very similar to the number of applicants per opening. When there’s a high number of candidates, the ratio approaches 0. The selection ratio provides information such as the value of different assessment and recruitment tools and can be used to estimate the utility of a given selection and recruitment system.

To calculate the utility of these tools, take a look at this article by Sturman (2003) on the ROI of selection tools.

12. Cost per hire

The cost per hire recruitment metric is the total cost invested in hiring divided by the number of hires.

Cost per hire consists of multiple cost structures which can be divided by internal and external cost. Internal costs include compliance costs, administrative costs, training & development, and hiring manager costs. External costs would be background checks, sourcing expenses, travel expenses, or marketing costs.

By quantifying all of them, you can calculate the total recruitment cost and divide it by the total number of hires:

Cost per hire = (Internal recruiting costs + External recruiting costs) / Total number of hires

Here are some examples of how you can quantify the costs:

- Time spent by recruiter = Average wages x Hours spent

- Time spent by manager = Average wages x Hours spent

- New hire onboarding time = Average wages x Hours spent

13. Candidate experience

When we talk about recruiting metrics, candidate experience shouldn’t be overlooked. Candidate experience is the way that job seekers perceive an employer’s recruitment and onboarding process, and is often measured using a candidate experience survey. This survey uses Net Promoter Score and helps to identify key components of the experience that can be improved.

Keep in mind that you can measure candidate experience in different stages of the recruitment process. And don’t rule out unsuccessful candidates. You should measure them along with the ones you’ve ended up hiring to get a more accurate picture of the state of your candidate experience.

14. Offer acceptance rate

The offer acceptance rate compares the number of candidates who successfully accepted a job offer with the number of candidates who received an offer.

A low rate might be indicative of potential compensation issues. When these problems occur often for certain functions, the pay can be discussed earlier in the recruiting process in an effort to minimize the impact of a refused job offer. An example is by listing pay in the job opening or by asking for the candidate’s salary expectations.

Offer acceptance rate = Number of offers accepted / Number of offers made

15. % of open positions

The % of open positions compared to the total number of positions can be applied to specific departments or even to the entire organization.

A high percentage of open positions in a specific department can mean those positions are in high demand (for example, due to fast growth). It can also mean that there’s currently a low supply of workers in the market for those positions.

This metric can offer you insights into the current trends and changes happening in the labor market, which can be valuable when you’re building your talent acquisition strategy.

% of open positions = Total number of open positions / Total number of positions in the department or organization

16. Application completion rate

This is a talent acquisition metric that shows how many candidates who started a job application finished it. You can also measure the other way around as “Applicant drop-off rate”, ie. the share of candidates who did not finish the application.

Application completion rate is especially interesting for organizations with elaborate online recruiting systems. Many large corporate firms require candidates to manually input their entire CV in their systems before they can apply for a job. The drop-off in this process is indicative of problems, e.g. web browser incompatibility with the application system or a non-user-friendly interface.

HR Pro Tip

A simple way to check for any issues that might happen during your application process is to test it out yourself. This will help you understand what your applicants might struggle with and how you can improve it.

17. Recruitment funnel effectiveness

The recruitment process can be seen as a funnel that begins with sourcing and ends with a signed contract. By measuring the effectiveness of all the different steps in the funnel, you can specify a yield ratio per step.

Yield ratio = Number of applicants who successfully completed the stage / Total number of applicants who entered this stage

For example:

- 1:15 (750 applicants apply, 50 CVs are screened)

- 1:5 (50 screened CVs lead to 10 candidates submitted to the hiring manager)

- 1:2 (10 candidate submissions lead to 5 hiring manager acceptances)

- 2:5 (5 first interviews lead to 2 final interviews)

- 1:2 (2 final interviews lead to 1 offer)

- 1:1 (1 offer to 1 hire)

The recruiting funnel has changed a lot over the last few years due to advances in HR tech. The first few steps are often atomized: software helps to automatically screen CVs and select the best fits. Some companies opt to go for video interviews to change submittals and even first interviews.

In other words, expect this funnel to change over time.

18. Cost of getting to Optimum Productivity Level (OPL)

The cost of getting to Optimum Productivity Level (OPL) is the total cost involved in getting someone up to speed. This includes things like onboarding cost, training cost, the cost of supervisors and co-workers involved in on-the-job training, and more. Usually, a percentage of the employee’s salary is also included in this calculation until they hit 100% OPL.

On top of this metric, there is also the “logistical” cost of replacing an employee. These are also called the cost per hire. Research estimates the OPL cost in retail at approximately $23,000 and in IT at over $37,000.

19. Time to productivity

Time to productivity, or time to Optimum Productivity Level, measures how long it takes to get people up to speed and productive. It is the time between the first day of hiring and the point where the employee fully contributes to the organization.

According to the same research mentioned above, the average time a new employee takes to reach their OPL is 28 weeks. Employees from within the same industry usually take less, while employees from outside the industry take significantly longer (32 weeks). University graduates (40 weeks), school leavers (53 weeks), and unemployed (52 weeks) take the longest time.

20. Adverse impact

Adverse impact is the negative effect biased and unfair employment practices have on members of protected groups. These practices can include hiring, learning and development, promotion, transfer, and performance appraisals.

Tracking this metric is the key to ensuring that your HR practices and activities can contribute to building a more diverse and inclusive workforce, that you have a fair hiring process, and that you comply with (local) legislation.

The four-fifths rule is a useful tool to determine whether or not there is an adverse impact in your selection process and other employment practices. According to this metric, the selection rate of protected groups — which include race, sex, age (40 and over), religion, disability status, and veteran status — should be 80% or more of the selection rate of non-protected groups to avoid adverse impact against the former.

For example, if 7% of female job candidates and 19% of male candidates are moved to the interview stage, you can divide 7 by 19 to get the impact ratio of 37%. This is less than 80%, which means that female candidates are adversely impacted in this case.

21. Recruiter performance metrics

Just like how it’s important to track the performance of your recruitment channels or process, you also need to measure how well your recruiters are doing. You can do this through various metrics, most of them focusing on the channel that your recruiters use to communicate with candidates, which is email.

For example, you can look at email open rate, which is the percentage of sent emails that candidates opened.

Open rate = Number of opened emails / Number of emails delivered

The response rate is also a good metric to look at, which measures the percentage of emails that candidates reply to.

Response rate = Number of replies / Number of emails delivered

Another metric is the conversion rate, which is the percentage of emails that lead to interviews.

Interview conversion rate = Number of candidates interviewed / Number of cold emails delivered

22. Fill rate

Fill rate helps the recruitment team determine how many jobs have been filled over a specific period compared to how many jobs are currently open and work to minimize the number of open vacancies at any given time.

Fill rate = Total number of jobs filled / Total number of job openings

The higher your fill rate is, the more it suggests that the recruitment team is effectively filling vacancies at pace. However, if you also have a low new hire retention rate, this may suggest that not enough time or care is being spent during the interview process to ensure the right people are being hired for the right roles, which is why metrics must be used in tandem to gather a full picture.

A low fill rate suggests issues in your recruitment strategy and a potential inefficiency or lack of effectiveness in the recruitment channels being used.

23. Recruitment ROI

Recruitment ROI (Return on Investment) helps measure the overall effectiveness and financial return of your recruitment strategies. This includes your activities to attract, hire, and retain your top employees. In other words, it measures the value generated from hiring efforts relative to the costs involved.

A positive ROI suggests that your recruitment efforts create more value than they cost. In contrast, a negative ROI indicates that you spend more on recruitment than the value those activities create.

To calculate your recruitment ROI, you must track key metrics (like the first-year attrition rate, offer acceptance rate, application completion rate, time to hire, and quality of hire), in addition to the monetary value of new hires (their revenue and productivity impact) and your hard costs (such as internal hiring costs, onboarding and training costs, replacement costs, technology costs, etc.).

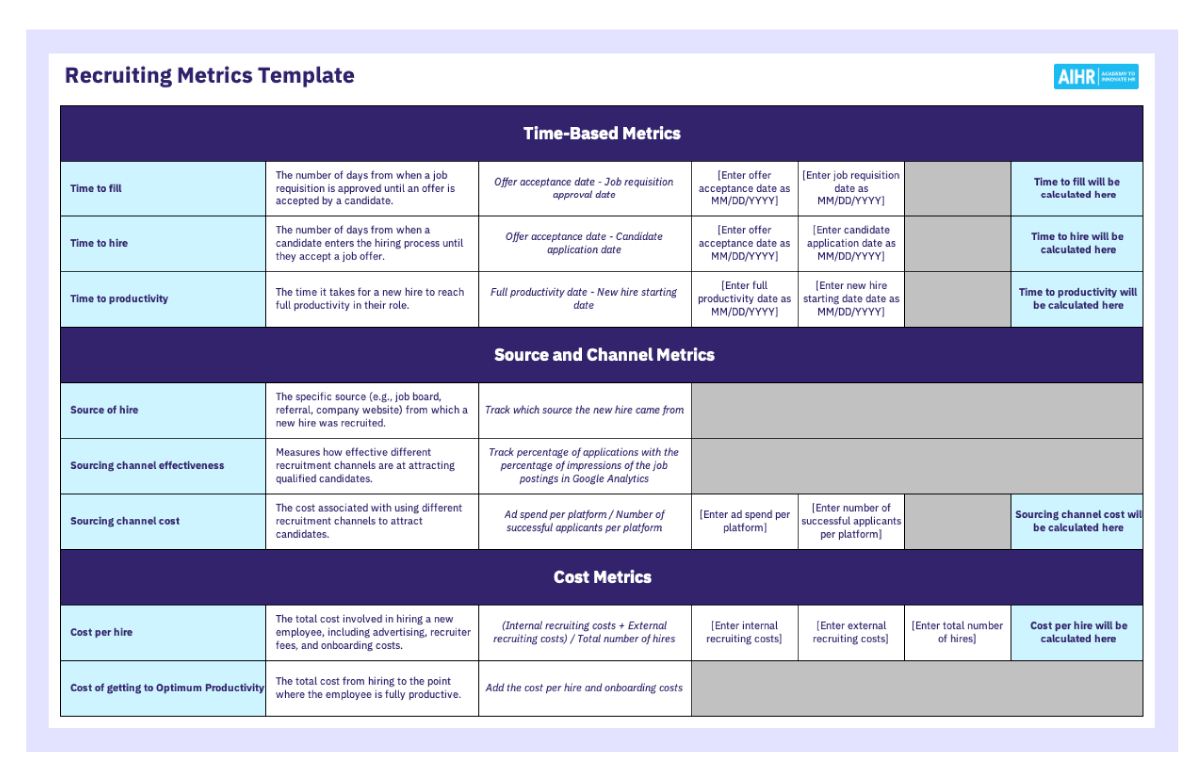

Recruiting metrics template

A recruiting metrics template with a comprehensive list of key metrics, definitions, and formulas helps talent professionals efficiently track and evaluate their recruitment processes.

This essential tool allows you to easily calculate metrics such as time to fill, cost per hire, and application completion rate and enables data-driven decision-making in recruitment. That way, you can identify areas for improvement and optimize the overall recruiting strategy.

Over to you

These 23 recruiting metrics form the basis of recruitment analytics.

And how do you know what the results mean? You can set internal recruiting metrics benchmarks, track your progress, and/or compare your results to industry benchmarks.

If you want to read more about different organizational metrics, check out our articles on the 21 employee performance metrics or 19 HR metrics.

FAQ

Commonly tracked recruiting metrics include time to fill, time to hire, source of hire, quality of hire, applicants per opening, cost per hire, offer acceptance rate, and application completion rate.

To measure recruitment, you can track a variety of different metrics, such as source of hire, candidate experience, first-year attrition, sourcing channel cost, and more. Combining these different metrics helps build a clearer picture of your recruitment pipeline from attraction to onboarding. With this information, you can make key improvements that will help you provide a better recruitment experience to candidates and attract and retain top performers.

An example of a strategic recruiting metric is offer acceptance rate, which helps you understand the number of candidates who accepted a job offer with your organization compared to the number who received an offer. If this metric is low, you know that issues within your hiring process need to be addressed. For example, you took too long, and competitors poached your top candidates, the compensation you’re offering is not competitive, or your interview process didn’t create a friendly and welcoming atmosphere. With this knowledge, you can start to make improvements that help you win the best talent.

There are many different thoughts when it comes to the most underutilized metric in recruiting, one of which is the quality of candidates who are not given an offer. For example, is your recruitment process inadvertently filtering out high-quality candidates too early? Furthermore, if high-quality candidates are consistently not being offered positions, it might highlight areas for improvement in the selection criteria, interview process, or candidate engagement strategies.

Identifying high-quality candidates who weren’t offered a job this time around also provides an opportunity to keep them engaged for future roles, saving time and resources in the long run by building a talent pool that you can tap into later.

You can evaluate recruiter performance by using several metrics. Most of these metrics focus on the primary channel recruiters use to communicate with candidates: email. For example, the email open rate or response rate, as well as their interview conversion rate.

Weekly update

Stay up-to-date with the latest news, trends, and resources in HR

Learn more

Related articles

Are you ready for the future of HR?

Learn modern and relevant HR skills, online