How to Measure Quality of Hire to Drive Business Results

The Society for Human Resource Management declared quality of hire as the holy grail of recruiting five years ago. Today, 88% of organizations believe it will be the most significant measure of recruiting success over the next five years. What exactly is quality of hire and how to measure it?

Although quality of hire has been a concern for several years, the COVID-19 pandemic made business leaders acutely aware of how critical having the right people in the right place determines business success. Suddenly, CEOs who were focused on strategy found themselves without people to execute it. They needed resilient talent to navigate the crisis, change their ways of working, and adapt to new realities. Getting the talent they need has become their top concern.

How can you make sure that you’re measuring quality of hire in a way that is best for your organization? Let’s find out.

Contents

What is quality of hire?

Why is quality of hire so hard to measure?

Why should you measure quality of hire?

Measuring quality of hire

The search for a simple quality of hire formula

Developing your quality of hire scorecard

What is quality of hire?

Quality of hire is a key recruiting metric that represents the value a new hire adds to your company, specifically, how much a new hire contributes to your company’s long-term success.

Leaders want to hold their recruiting and talent operations accountable for quality and efficiency. Speed also matters because the ability to fill jobs on time affects a company’s ability toscale and boost revenues.

Organizations can measure quality of hire for each new employee, as well as calculate overall quality of hire at their company.

ISO/TS 30411:2018 defines six metrics:

- Quality of hire: the performance of an individual after hire compared to pre-hire expectations.

- Impact of hire: the new hire’s contribution to the success of the organization.

- Retention rate: percent of employees retained over a defined period.

- Turnover rate: the ratio of separations against the total workforce.

- Pre-hire expectations: minimum acceptable criteria set before hiring.

- Performance: measurable result.

Most working definitions of quality of hire (QoH) include more dimensions than the narrow ISO definition.

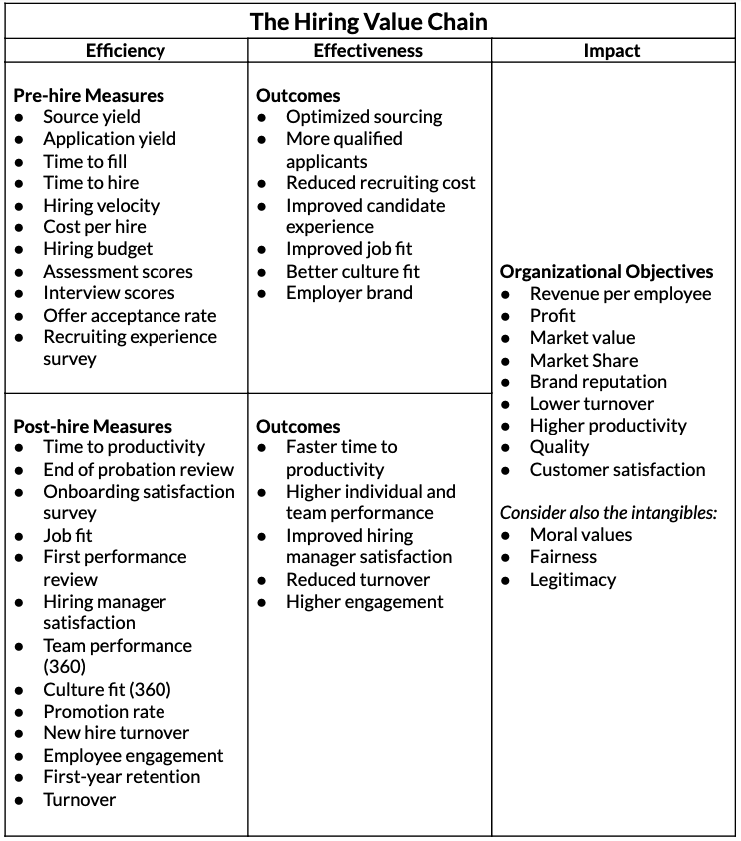

A common practice in HR years past was to equate quality of hire and first-year individual job performance. We now think of quality of hire as an essential component of the HR value chain. We have empirical evidence of how HRM practices drive HRM outcomes, and HRM outcomes drive organizational success.

When we apply that principle to the hiring practices, we can get a clearer view of how delivering the right talent to the right place in the organization creates value.

Why is quality of hire so hard to measure?

We’re not surprised that practitioners find QoH hard to define and measure. As in any quality measure, the customer defines quality—and that is only the beginning of the measurement process. There are five challenges even the best of us face in measuring quality of hire:

- What defines a quality employee differs across business sectors, industries, individual organizations, and, most importantly, job roles.

- Getting stakeholders to agree on quality can be difficult. The perspective of executives, board members, managers, HR, and workers can differ. Although we can agree on principles, most companies will have at least some differences in their perceptions of quality and its impact on their business.

- You can’t get an accurate picture of performance until enough time has passed to assess it—usually a few months. Even then, getting an agreement is difficult.

- Culture is a critical component of job fit, which is a primary determinant of job success. Culture is not a single data point or dimension. It is a multi-dimensional construct that most organizations have difficulty understanding.

- Human assessments, such as performance reviews and team 360s, are subject to rater bias.

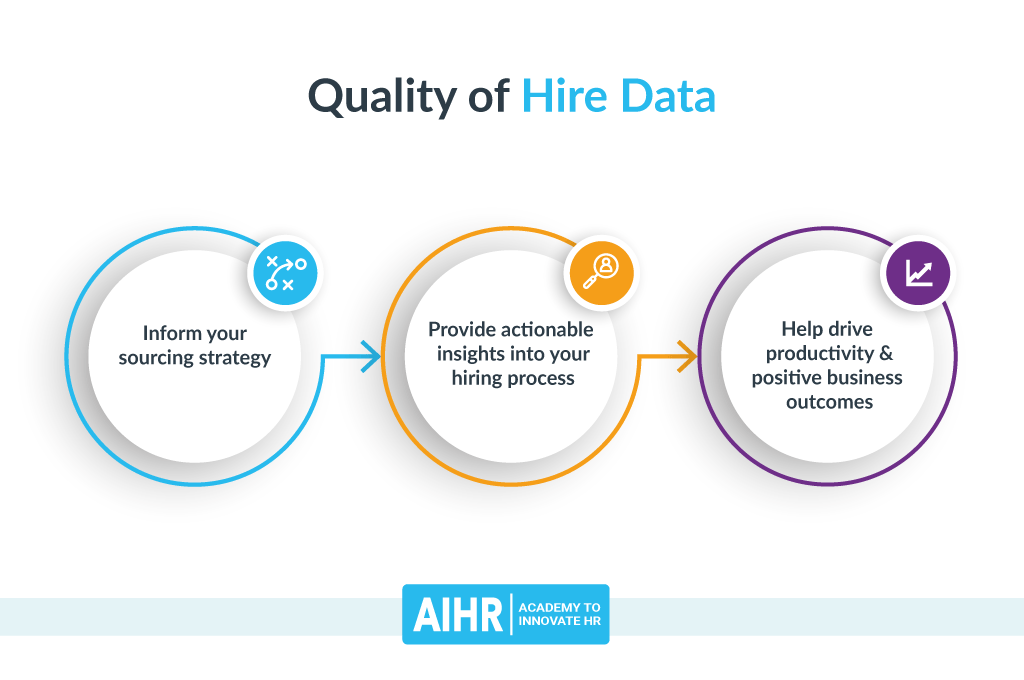

Why should you measure quality of hire?

Despite the challenges, we urge you to measure and understand what quality of hire means to your business because the success of your organization depends on it.

- You need to know what a quality candidate is before you can recruit one. As Dr. W. Edwards Deming would say in his workshops whenever an attendee stated an opinion: “How would you know? Have you measured it?”

- A good fit helps you build and reinforce your culture. Your organization will become whom you recruit.

- Talent creates value. In his Talent to Value series, Sandy Ogg shares his path to success with the Blackstone investment firm. His experience shows us that with the right talent in the right place, your organization can succeed.

- Measurement drives excellence. As our Hiring Value Chain above shows, measuring and improving the efficiency and effectiveness of the talent acquisition processes that acquire and onboard the right talent drives better business outcomes.

Despite all the challenges, we encourage you to make measuring quality of hire a top priority in your organization.

Measuring quality of hire

In the past, we measured what was easy to calculate and readily available: time to fill as a recruiting measure and individual performance ratings as a candidate measure. However, it has now shifted to measuring the value and contributions your new hires add to the organization.

As our ability to measure processes and outcomes has grown, so has the list of measures we can use to evaluate results.

We differentiate between pre-hire and post-hire measures partly because the moment of hire is when the candidate/new hire experience transfers from Recruiting to Management, Talent, and HR support functions. More important is that most of the pre-hire metrics measure recruiting efficiency and effectiveness.

In contrast, post-hire metrics measure the new hire’s performance and how well management supports that performance and the employee experience. Those are the metrics that are often used to measure quality of hire as a way to evaluate the new hires’ contribution to the company.

Here are the measurements we see in everyday use:

Pre-hire measures

Source Yield enables you to measure each source’s value to focus your spend on those with the best return on your recruiting investment.

Source Yield Ratio = Number of leads from source ÷ Number of candidates invited to interview

Time to Fill is an internal recruiting efficiency measure usually but not always the number of days between the approval of a job requisition and the date the candidate accepts an offer. It is one of the measures cited in ISO 30414 guidelines. It measures the entire process from the recruiting perspective.

Time to Fill = networkdays(offer acceptance – requisition date)

Time to Hire is the number of days a candidate is in the pipeline, from application to acceptance. While time to fill focuses on recruiting efficiency, time to hire assesses the candidate experience. Both measures have a critical dependency—the number of candidates suitable for the job. You want to have enough candidates to compare to make the right choice unless you hire for that position frequently enough to have a good benchmark. See our article on time to hire for a deeper look into this metric.

Time to Hire = Date offer accepted – Application date

In addition to the total time to hire, you can measure the time for each stage.

Hiring Velocity measures the percentage of jobs filled on time. The time it takes to recruit for different positions varies, so you should plan what “on time” means for each role.

Hiring Velocity = (Number of on time hires ÷ Total hires) × 100%

Cost per Hire, though it is a factor you can measure and control, can lure you into believing you are having an impact by saving money. It doesn’t take into account that cost and time vary by role. Consider also that some positions are so critical to the business that they fall outside normal parameters.

Cost per Hire = Sum of recruiting costs ÷ Number of hires

Hiring Budget, a measure recently devised by SmartRecruiters, benchmarks recruiting costs to the variable costs of different types of roles.

Hiring Budget = Total recruiting costs ÷ New hire payroll

Candidate Assessment Scores, with over a hundred years of empirical evidence behind them, can be instrumental in predicting suitability for a job. We saw the results in a large call center that cut new-hire attrition in half by implementing a job-specific assessment for customer service agents.

There are hundreds of providers, and it is easy to find a scientifically validated instrument for your industry.

Interview Scores. Most companies use a scoring sheet or scorecard for hiring managers and interviewers to grade candidates. The process requires a consistent rating system with validated criteria and questions. If you’re a member, you can get a sample Candidate Evaluation Form from SHRM.

Interview Score = Total of scores for each criterion ÷ Number of scores

Offer Acceptance Rate can help you identify compensation issues or a problem with communicating salary expectations. Discussing salary early in the process can prevent those issues.

Offer acceptance rate = Number of offers accepted ÷ Number of offers made

Recruiting Experience Survey. A survey designed to measure the candidate’s experience during the recruiting process can help you spot trouble spots at any point. It can help you identify communication lags, failure to respond, and failure to provide accessible information, among other factors. You could even survey candidates who “ghosted” you to learn the reason.

Post-hire measures

Time to Productivity is the measure of the number of days from the hire date until the new employee reaches full productivity. For a new customer service rep, it may be a week or less. For a marketing Mmanager, it could be months or more. Problems with time to productivity can uncover issues in the onboarding process, including training and management support.

Time to Productivity = networkdays(Date of full productivity – Hire date)

End of Probation Review. A review at the end of the probation period can help assess how well candidates adapted to the new job or reflect the quality of the onboarding process. Like all reviews, it can be subject to hidden biases, so it is a good practice to benchmark this review as you do your other periodic reviews. You should also conduct surveys of new employees on the onboarding process to read better how well they are being supported in the new role.

Onboarding Survey. Asking new employees about the onboarding process, periodically and up to the end of probation, can help you identify whether the new employees are experiencing challenges in adapting and how well they are supported during the ramp-up process.

Job Fit. In our experience, a poor job fit often shows up quickly during the ramp-up, but it can remain hidden.

SmartRecruiters recommends a Net Hiring Score (NHS), similar to the Net Promoter Score for customers. You can use it as a pulse metric to show how you are doing in finding the right people for jobs. It is a three-step process:

- Ask the hiring manager: On a scale of 0-10, how much of a fit is this new hire for the job?

- Ask the new hire: On a scale of 0-10, how much of a fit is this new job for you?

- Subtract the percentage of great fits (answered 9 or 10) from the percentage of poor fits (0-6) and multiply by 100.

If the score is <0, you are hiring more poor fits. If >0, you are hiring more great fits. Zero indicates a neutral impact on the organization.

Hiring Manager Satisfaction. A satisfaction survey of hiring managers can identify whether a new hire is a great fit and help you identify areas for improvement. Remember that like any manager assessment, it can be subject to hidden bias.

Team Performance. A 360-degree feedback can help you identify new hire performance, teaming success.

Culture Fit Survey. A culture fit survey can help you determine how well the new employee meshes with your company culture.

Promotions. Many companies rely on an assessment of how quickly new employees are promoted. In companies where career progression is the expected norm, how quickly an employee moves up can indicate job fit.

The search for a simple quality of hire formula

We can offer a generalized formula in which the organization agrees on indicators and weights to develop a scorecard.

Quality of Hire = (Indicator 1 % + Indicator 2 % + Indicator 3 %…) ÷ Number of Indicators

Most organizations try to find a simple, straightforward mix of factors. A majority of respondents to LinkedIn’s 2020 Future of Recruiting survey identified employee engagement, employee retention, and performance ratings as the most effective.

Other examples suggest new hire performance, retention, and hiring manager satisfaction as a workable model, or a combination of new hire performance metrics, engagement, and culture fit.

We saw the value of a flexible approach in an outsourced customer service center as far back as the late ’90s. A new contract required a company to hire hundreds of new employees in less than a week. They ignored the budget, measured baseline job fit with a calibrated assessment, and focused on velocity. For them, hiring success was “butts in seats.”

SmartRecruiters offers a more flexible Hiring Success Scorecard that companies can adjust each factor’s relative weight to fit the organization and each job. The three factors are:

- Hiring Budget (total recruiting costs / new hire payroll). Rather than thinking of recruiting costs as an expense, this model considers those costs as an investment in people.

- Hiring Velocity (percentage of jobs filled on time) focuses on delivering value, considering the variability of the time it takes to hire specific skill sets.

- Net Hiring Score measures the fit between new hires and jobs based on a survey of both hiring managers and new employees after ramp-up time.

Developing your quality of hire scorecard

Developing your measurement program will take time, and it won’t be easy.

- You need to find the right formula, which could mean months or even years of experimentation.

- It requires tracking all the metrics that drive QoH on a long-term, continuous basis.

- As your business changes, your quality of hire metrics may change.

Getting to an agreement on your QoH metrics will take a collaborative effort.

Sandy Ogg argues that the traditional roles in which the CEO sets direction and strategy, the CHRO manages talent, and the CFO manages value won’t do what is necessary to put talent in the right place at the right time. The starting point is for them to work together to define the roles that add value to the organization.

While Ogg’s approach is specific to executive talent, the principle of collaboration among Operations, Finance, and HR to drive talent to value will create the conditions for delivering that value.

With that in mind, we recommend these general steps to build your quality of hire measurement program:

- Create a cross-functional team. You will need the perspective of the people and functions that impact and benefit from hiring quality.

- Develop a scorecard of top-level measures. Choose measures that give you a broad picture of how well your organization delivers the right talent where and when you need it. Your scorecard should reflect your business strategy and the values that matter most to your organization.

- Analyze your results and fine-tune your criteria as you go. Finding the right mix may take some time, but the effort will be well worth it. You may find you need many scorecards for individual functions and roles.

- Analyze and optimize your approach frequently to keep pace with changes in your business.

Example scorecards

Here are some examples to help you get started.

Example 1

In the first example, we have a company more focused on the quality of the new hire than the effectiveness of the processes.

The scorecard might include:

- Time to Productivity, with a benchmark number of days for each job role.

Time to Productivity Score = (Number of Days to Full Productivity ÷ Job Benchmark) x 100%

- End of Probation Review.

End of Probation Review = (Performance Rating ÷ Satisfactory Performance Score) × 100%

- Job Fit, based on both manager and employee assessment.

Job Fit = ((Employee Score + Manager Score) ÷ 2) × 100%

In this case, you can also apply the simple formula for calculating quality of hire we described above:

Quality of Hire = (Time to Productivity Score + End of Probation Review + Job Fit) ÷ 3

Example 2

You may want to take a broader view that considers all the contributors to the hiring process:

- Pre-hire Assessment Score.

Pre-hire Assessment = Assesment Score ÷ Benchmark

- Job Fit, based on both manager and employee assessment. It could also serve as a quality check on your pre-hire assessment.

Job Fit = (Employee Score + Manager Score) ÷ 2

- The investment required to get candidates in the door.

Hiring Budget = Total Recruiting Costs ÷ New Hire Payroll

- Time to Productivity, as an indicator of how well managers develop their new hires.

Time to Productivity Score = Number of Days to Full Productivity ÷ Job Benchmark

- Onboarding Satisfaction Survey.

Example 3

If “butts in seats” is your priority, a scorecard such as this may work.

- Hiring Velocity.

Hiring Velocity = (Number of on time hires ÷ Total hires) × 100%

- Time to Productivity.

Time to Productivity Score = Number of Days to Full Productivity ÷ Job Benchmark

- New Hire Retention

New Hire Retention = Number Retained After Ramp up ÷ Total Number Hired

- Hiring Budget

Hiring Budget = Total Recruiting Costs ÷ New Hire Payroll

A final word

If the pandemic has taught us anything, it is that having the right talent in the right place will determine your enterprise’s success, and that talent is what creates value. Monitoring how well you measure quality of hire may take effort, but it will have a significant impact on your business.

Analyze your results and fine-tune your criteria as you go. Finding the right mix may take some time, but the effort will be well worth it.

Weekly update

Stay up-to-date with the latest news, trends, and resources in HR

Learn more

Related articles

Are you ready for the future of HR?

Learn modern and relevant HR skills, online