Time Off in Lieu (TOIL)

What is time off in lieu (TOIL)?

Time off in lieu (TOIL) is a practice where employees can take paid time off in compensation for extra hours they have worked beyond their regular working hours instead of receiving overtime pay. The term “in lieu” is French for “instead of”.

The amount of TOIL depends on the number of extra hours an employee works. The time off can be calculated at a rate of 1:1 (1 extra hour worked = 1 hour off). It is often granted at a rate of time-and-a-half or double time in special circumstances, like working weekends or holidays.

In some organizations, time off in lieu is used when a public holiday falls on a non-work day. For example, if a holiday falls on a Sunday, employees receive an “in lieu of” holiday on Monday.

Time off in lieu vs. overtime pay

Here is an overview of the key differences between time off in lieu and overtime pay.

Compensation

Paid time off to be used later in exchange for working extra hours, often granted at 1.5x or double the time worked.

Paid 1.5x or double pay for working overtime (e.g., over 40 hours per week).

Eligibility

Both exempt and nonexempt employees.

Nonexempt employees only under the Fair Labor Standards Act (FLSA).

Employee choice

Often optional/voluntary.

Mandatory for nonexempt employees.

Tax implications

Typically considered as regular paid time off.

Varies depending on location and situation.

Benefit for employers

Can help manage payroll expenses by not increasing immediate financial liabilities.

Can be more straightforward to manage and administer but increases payroll costs.

Time off in lieu vs. compensatory leave

Both time off in lieu and compensatory leave (or comp time) provide paid time off in exchange for receiving overtime pay, but there are some important distinctions.

Compensatory leave has stricter legal requirements and is more regulated than TOIL, particularly in the U.S.:

- Eligibility: Comp time is often restricted to certain types of employees (e.g., exempt or government workers), while TOIL can be offered to a wider range.

- Accrual limits: Compensatory leave often has a mandated maximum accrual amount. TOIL policies can be more flexible and set by an organization.

- Usage time restrictions: For nonexempt employees, compensatory leave usually has a time limit under FLSA regulations (used by the end of the 26th pay period).

- Cash payouts: Compensatory leave is not generally eligible for cash payout, but TOIL can be depending on the specific company policy.

Advantages and disadvantages of time off in lieu

Advantages

- Reduced payroll costs: Instead of paying overtime, which is usually at a higher rate (1.5x of wages or double pay), companies can reduce payroll costs with a TOIL policy.

- Employee wellbeing: By allowing employees to compensate for long working hours with equivalent time off, employers can help prevent burnout and promote a healthier work-life balance.

- Greater flexibility: Having more options for taking time off beyond traditional annual leave gives employees greater flexibility and choice.

- Enhanced planning for busy periods: When companies don’t have to worry about paying excessive overtime, they can better plan ahead for busy periods without increasing labor costs.

Disadvantages

- Difficult to monitor and track: TOIL requires meticulous management to ensure that time off is accurately recorded and taken within policy guidelines. This can increase administrative burdens on HR teams.

- Excessive time off: If not regulated properly, workers can accrue excessive time off. This may lead to being short-staffed, especially if employees attempt to use up all their time off before the end of the year.

- Legal implications: TOIL policies require strict compliance with labor laws, which may vary depending on location. HR must follow compensation and benefits regulations to avoid penalties or potential lawsuits.

- Potential for employee abuse: Some employees may attempt to accrue time off in lieu to earn extra days off. It’s important to set clear guidelines for approval of TOIL, such as setting a limit on the amount of hours per work period.

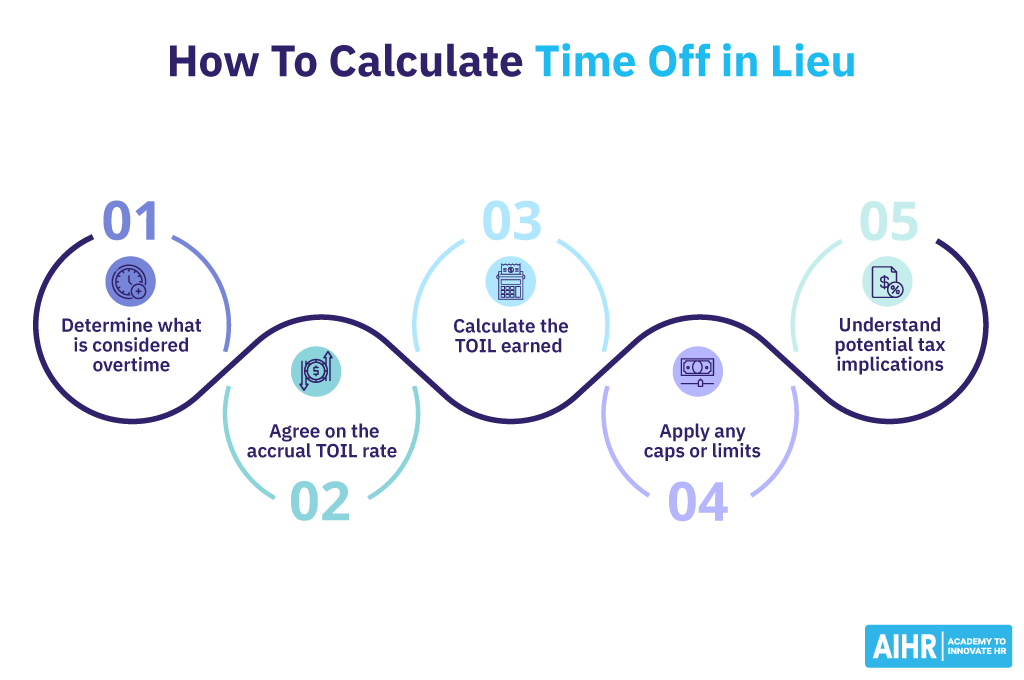

How to calculate time off in lieu

Time off in lieu requires detailed tracking to ensure fairness and legal compliance. Here is a detailed guide HR professionals can use to calculate TOIL:

- Determine overtime hours: Establish clear guidelines for what is considered overtime in your organization (e.g., over 40 hours per week or any other specific criteria). Implement accurate timekeeping systems to track employees’ TOIL hours (accrued and used). Ensure employees understand their overtime eligibility and their option for TOIL.

- Agree on the accrual rate: Employees should know the rate at which TOIL is earned (e.g., 1 hour overtime = 1 hour TOIL or higher rates for weekend or holiday work). Make sure the accrual rate is documented and easily accessible.

- Calculate the TOIL earned: Once overtime hours have been determined, apply your TOIL accrual rate. For example, if an employee worked 5 hours overtime at a 1:1 accrual rate, they would be eligible for 5 hours of TOIL.

- Apply any caps or limits: To ensure legal compliance with labor laws, limit the amount of TOIL employees can accrue. Communicate and document any caps or limits to employees so they comply with your TOIL policy.

- Understand potential tax implications: Tax laws for TOIL can differ depending on your location. If TOIL is converted to cash (either upon request or after reaching maximum accrual), it is usually treated as taxable income for employees and subject to payroll taxes for employers. HR professionals should be familiar with the tax regulations in their state or region.

Time off in lieu policy: Important considerations for HR

How can HR implement a well-defined TOIL policy? Here are some key ways:

- Provide clear policy guidelines: Your organization’s TOIL policy should be clearly outlined, including eligibility, the process for accruing and taking time off, and any limits or caps on accumulation. This policy should be communicated transparently and well-documented for all employees.

- Ensure legal compliance: Follow relevant overtime regulations and associated labor laws to ensure time off in lieu meets necessary legal requirements. Having accurate documentation of employee overtime hours, accumulations, and usage can support internal audits to ensure TOIL policy meets legal compliance.

- Define how TOIL is accrued: Determine the overtime accrual rate for TOIL (whether it’s 1:1 or higher rates for weekends, holidays, or busy periods). Establish a transparent system for calculating and tracking these hours. Many HR departments integrate TOIL tracking into their payroll system for easier management.

- Requesting and using TOIL: Clearly outline the process for requesting time off in lieu, such as prior approval procedure, advance notice periods, or times when TOIL can’t be used (e.g., high-peak periods).

- Establish caps and expirations: Have clear limits on how much TOIL employees can accumulate to prevent excessive overtime hours. Also define the criteria for handling unused hours. Some suggestions include having options for carrying over TOIL or offering a cash payout to encourage complete usage.

HR tip

Proactively anticipate employee questions about your TOIL policy, including its benefits and limitations. Provide a comprehensive FAQ that answers the most common questions and concerns.

FAQ

Offering Time Off In Lieu (TOIL) instead of overtime pay is optional and requires agreement between employers and employees. Legal guidelines vary by country, aiming to prevent worker exploitation through TOIL. Organizations should check local labor laws to ensure their TOIL policy complies.

Generally, overtime pay is required in many places, with the U.S. Fair Labor Standards Act mandating 1.5 times the hourly rate for nonexempt employees working over 40 hours weekly.

Time off in lieu is legal in many jurisdictions when implemented according to local labor laws, which often require a mutual agreement between employer and employee. This agreement should detail how and when TOIL can be used, ensuring fairness and preventing exploitation. Legal frameworks may regulate TOIL’s use, including record-keeping, accrual limits, and ensuring voluntary participation. Thus, while TOIL is a flexible option for managing overtime, its legality depends on compliance with specific legal standards and mutual consent.