Overtime Pay

What is overtime (OT)?

Overtime is the extra time an employee works out of their typically scheduled work hours. The term is also commonly used to refer to an employer’s remuneration for the extra working hours. Normal working hours are established to create a balance for employees’ health and productivity.

There is scientific proof that a human being is less productive on the eighth or tenth hour of work than at the beginning of their shift. The standard workday, according to many labor law regulations, is eight hours, and a workweek comprises 40 hours.

What is annual overtime?

Annual overtime is the total number of extra hours an employee works outside their normally scheduled working time in a year.

What’s considered overtime hours?

It is important to know what’s considered overtime hours at your workplace so that you can manage your expectations.

Different workplaces handle overtime hours differently. For most organizations, overtime only applies on a workweek basis, as the FLSA requires.

Work done on Saturdays, Sundays, holidays, and regular days of rest is not considered overtime unless the organization clearly states that in the employment contract.

What is overtime pay?

According to the Fair Labor Standards Act (FLSA), anyone who works beyond the standard 40-hour workweek is eligible for overtime pay. Overtime pay is the compensation employees get for working longer than standard hours.

If the normal work week is 35 hours and the employee works 50 hours, they are eligible to earn overtime pay for the extra 15 hours. Overtime pay rate varies in different companies and is determined by various factors besides hours worked.

How much is overtime pay?

The federal overtime laws require employers to compensate employees at least time and a half or double time for the extra time they put in. Time and a half is equivalent to more than 50% of an employee’s standard wage. For every hour of overtime, employees get their regular hourly rate, 1.5 times.

Who is exempt from overtime pay?

Regarding overtime, employees fall under two categories: exempt and non-exempt. In the United States, exempt employees do not receive overtime pay. Exempt employees are mostly professionals that make twice the minimum wage in their area of expertise.

Non-exempt employees get overtime pay when they work beyond their regular work hours. This employee group mainly consists of hourly workers like servers, retail associates, and contractors.

Is overtime pay mandatory?

Overtime pay is mandatory for all non-exempt employees. The eligibility is subject to state regulations, but the FLSA requires that all employers compensate their employees for extra hours worked beyond the normal working time.

How to calculate OT pay

Step 1: Determine if your employees are eligible for OT pay.

Before calculating overtime pay, the first thing to do is to determine whether your employees are exempt or non-exempt.

Step 2: Track employees’ weekly working hours

Non-exempt workers should keep track of their weekly hours so that you can calculate their overtime pay accurately. A timesheet is the best way of reporting the working hours to the employer.

Step 3: Know the overtime pay rate of your business

Some employers offer the standard OT pay rate of time and a half (1.5), some a double time rate, and others have a unique rate. Get an overview of what your organization’s overtime pay rates are for different roles. Ensure your business follows the legal requirements as per your state’s guidelines.

Step 4: Calculate overtime pay

The formula to calculate overtime pay for non-salaried employees:

Overtime pay for non-salaried employees = Hourly regular pay rate X Employer’s overtime pay rate.

Example: If an employee’s normal pay rate is $25 per hour, and your organization offers an OT pay rate of time and a half, the employee gets 1.5 X $25 = $37.5 for every extra hour.

The formula to calculate overtime pay for salaried employees:

Overtime pay for salaried employees = Hourly regular pay rate ((Annual salary/52 weeks)/40 hours) X Employer’s Overtime pay rate.

Example: If your employee earns $60,000 yearly and your OT pay rate is time and a half, the overtime pay = ($60,000/52)/40 X 1.5, which is $43.27 per hour.

Holiday overtime pay

This is the compensation employees receive for working on a holiday. It may be voluntary or compulsory.

Holiday overtime pay = Normal pay per day worked X Employer’s Overtime pay rate.

Example: If an employee earns $200 on a regular scheduled work day, and you offer the standard time and a half overtime pay rate, the holiday overtime pay will be:

$200 X 1.5 = $300

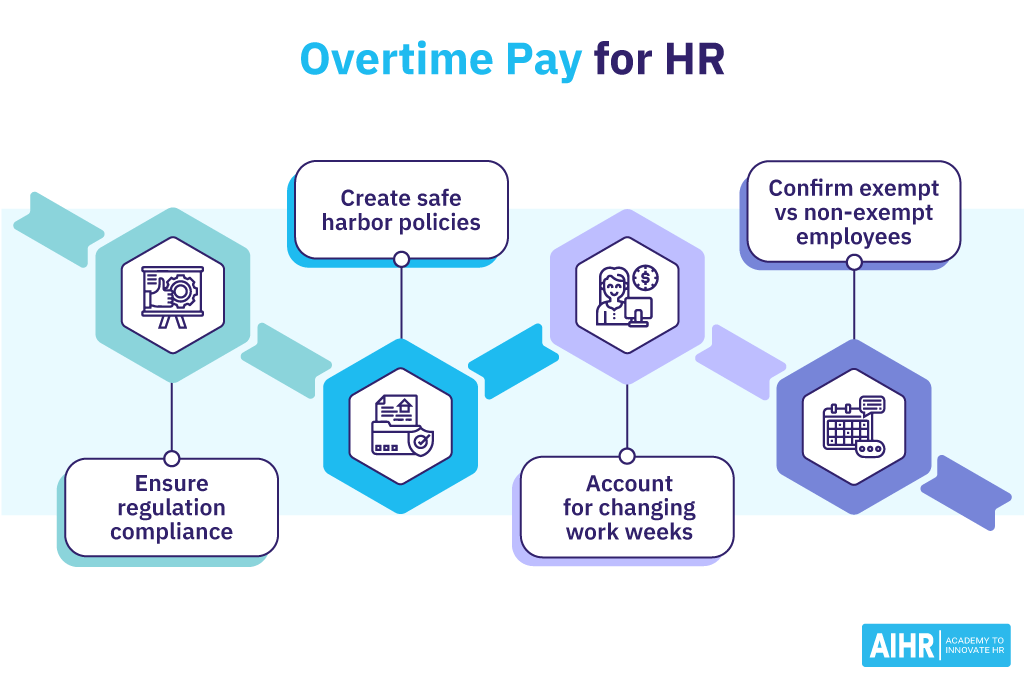

What HR should consider with overtime pay

1. Ensuring legal regulations are followed

HR must ensure the company complies with all wage and hour legislation concerning overtime. The Federal government’s minimum standard is one and a half times the regular pay rate for non-exempt employees who work over 40 hours per week.

2. Preventing overtime violations

HR can create safe harbor policies to prevent overtime violations. The policies should involve notifying employees in writing about the employer’s general salary and overtime pay obligations.

HR tip:

To ensure compliance with FSLA’s overtime regulations, the company should conduct an audit at least once yearly. Violating the rules could cost the company more than overtime payments.

3. Considerations for changes to work weeks

According to the FLSA, a work week has 40 hours, which are 8 hours for five days. The 4-day work week of 32 hours is increasingly becoming popular in many organizations. The changes in work weeks must be considered when structuring overtime policies to benefit both the employer and employees.

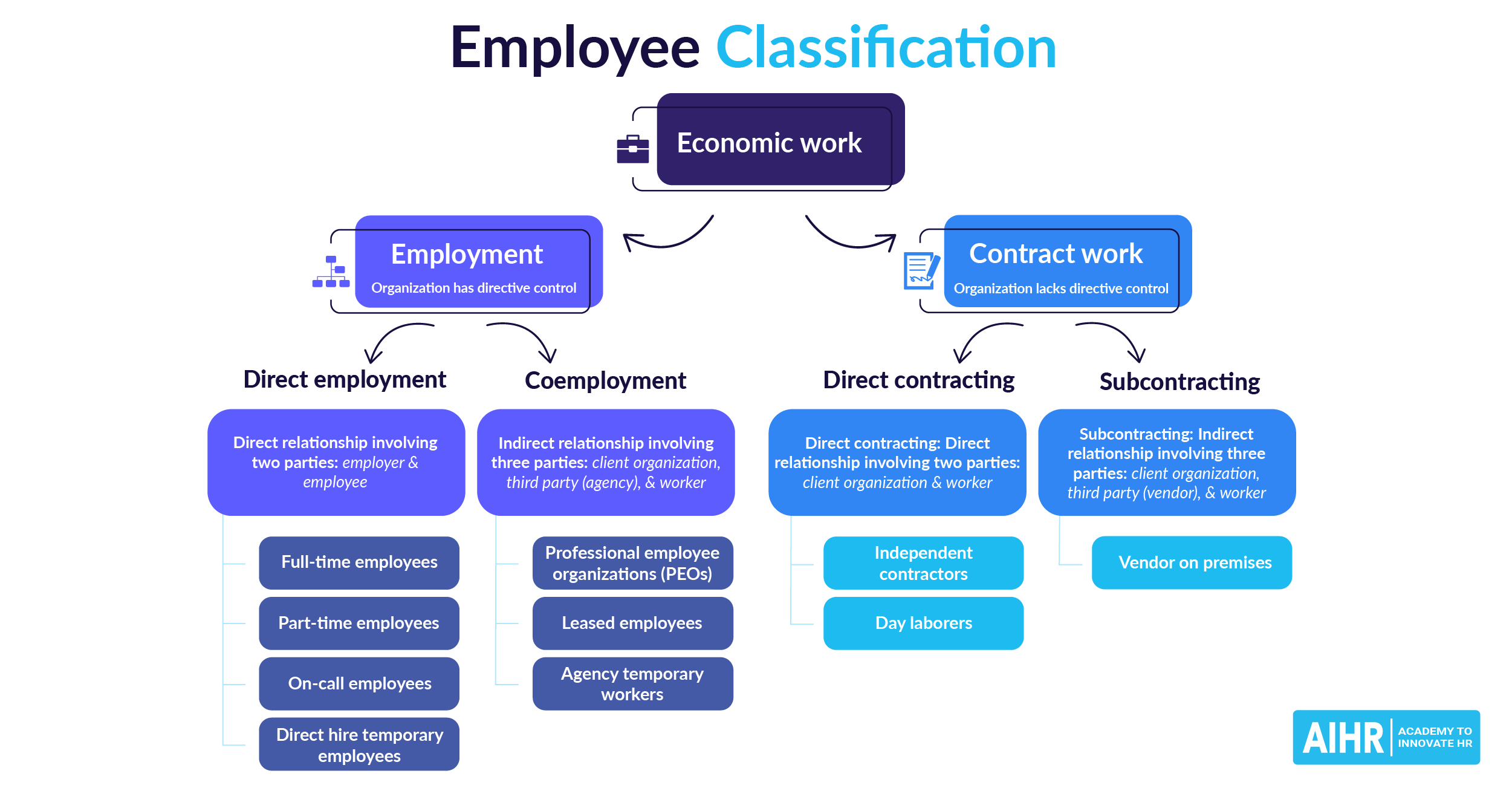

4. Misclassification

HR managers can consult their organization’s legal department for proper definitions of employee status of exempt and non-exempt to avoid misclassification.