Employee Classification: A Practical Guide for HR

The labor market is currently going through a period of change that impacts all its members, including employees, employers, and independent contractors. As more people find new ways to earn a living, businesses and organizations have to adapt to a more complex workforce with new roles and demands. Your organization might need to rethink its employee classification.

Let’s dive into the fundamentals of classifying employees, the most common types of employees, non-exempt and exempt employees, and why contingency workers are not traditional employees. By the end of this guide, you will understand the role and usefulness of each employee type and how to build an efficient employee classification policy that works for your business.

Contents

Why do you need to reassess your employee classification?

What are the types of employees?

Exempt employees vs non-exempt employees

What are contingent workers?

Remote workers vs. independent contractors

How to deal with a complex workforce

Why do you need to reassess your employee classification?

We can blame the pandemic for making navigating the workforce more complex than ever before. However, in reality, the trends we see today are supported by transformations that happened during the past several decades.

Plus, the fast development of broadband internet and the spread of portable devices opened the door to unforeseen job opportunities.

As a result, the labor market is now diverse, with plenty of options for anyone. This leaves companies struggling to meet the expectations of current employees and find talent. Yet, not everyone struggles.

Some companies found a way to strive despite the various challenges that popped up during the last couple of years.

So how do they do it?

Besides using advanced technology to improve productivity and reduce time spent with routine tasks, successful employers aren’t afraid of a diverse team that includes remote workers, full-time employees, and part-time employees (just an example).

The important part, in this scenario, is to make sure you have your employee classification right. This way, you can enjoy all the perks of having a diversified team without any business disruptions or gaps in productivity. Plus, when you understand the employee classification, it’s easier to decide which type(s) of employee best fits your business’s needs.

What’s more, if you check employer review sites like JobSage or Glassdoor, you’ll notice many reviewers appreciate their employers’ consistency and transparency, including when it comes to classifying employees. That’s because it provides people with a sense of reliability and trust.

What are the types of employees?

Based on the hours worked, job duties, and the expected duration of the job, most employers will classify their employees into five types, plus one extra type:

- Full-time employees

- Part-time employee

- Temporary employees

- Interns

- Seasonal workers

- Leased employees (the extra type)

Now, these terms don’t have a strict definition in the federal or state laws in the US. Each employer has some freedom when it comes to their employee classification policy. However, once defined, the same policy must be applied through the organization.

This helps employees understand their eligibility for benefits. They can also have a fair assessment of their wages in accordance with the number of hours per day.

Let’s explore each type of employee in more detail.

1. Full-time employees

Full-time employees usually work an average of 40 hours per week, are eligible for benefits, and may not have a set end date for their contracts. They are the so-called permanent employees. Also, if the business or organization has 50+ full-time employees in the US, it must offer health care coverage (health insurance) to these employees and their dependents.

Full-time employment is often considered one of the most reliable and safe work conditions because employers offer a fixed salary plus overtime pay (calculated by the hour).

However, in a job that only offers minimum wage, full-time employment can be a disadvantage, making it difficult for businesses to retain talent.

2. Part-time employees

These individuals work less than 40 hours per week and are usually paid on an hourly basis. Yet, some part-time employees prefer a salary basis, so it depends on the company.

Plus, part-time employees can also be permanent if the contract doesn’t have a set end date. Yet, these individuals may not be eligible for benefits.

3. Temporary employees

Unlike permanent employees, temporary employees (or temps, if you will) have a set end date on their contract. These individuals often work within a company for somewhere between six months to one or two years. Also, some people are hired for the duration of a project. Then, their contract ends when the project is complete.

Now, depending on the number of hours per week, you can have temporary full-time employees and temporary part-time employees. Overall, temporary workers are ideal for short-term projects and can help boost productivity during busy times.

Also, hiring temps is a great way to probe the workforce and test people’s skills without having to offer a permanent position.

4. Interns

Interns are usually hired for a short period of time (a few months at best) and can be paid, partially paid, or unpaid. They are generally high school or college students looking to gain their first work experience. Internships might potentially lead to employment in your company.

5. Seasonal workers

Another type of employee that is not permanent, seasonal workers are hired to cover a business’s seasonal increase in work. This need usually arises during a specific season of the year (winter holidays and summer months being the most common).

6. Leased workers

This type of worker or employee is still a salaried individual (not an independent contractor), but they don’t show up on your company’s payroll.

As the name suggests, a company can lease out employees from a staffing agency (from which they receive their payment) to complete a project or supplement staff during busy periods.

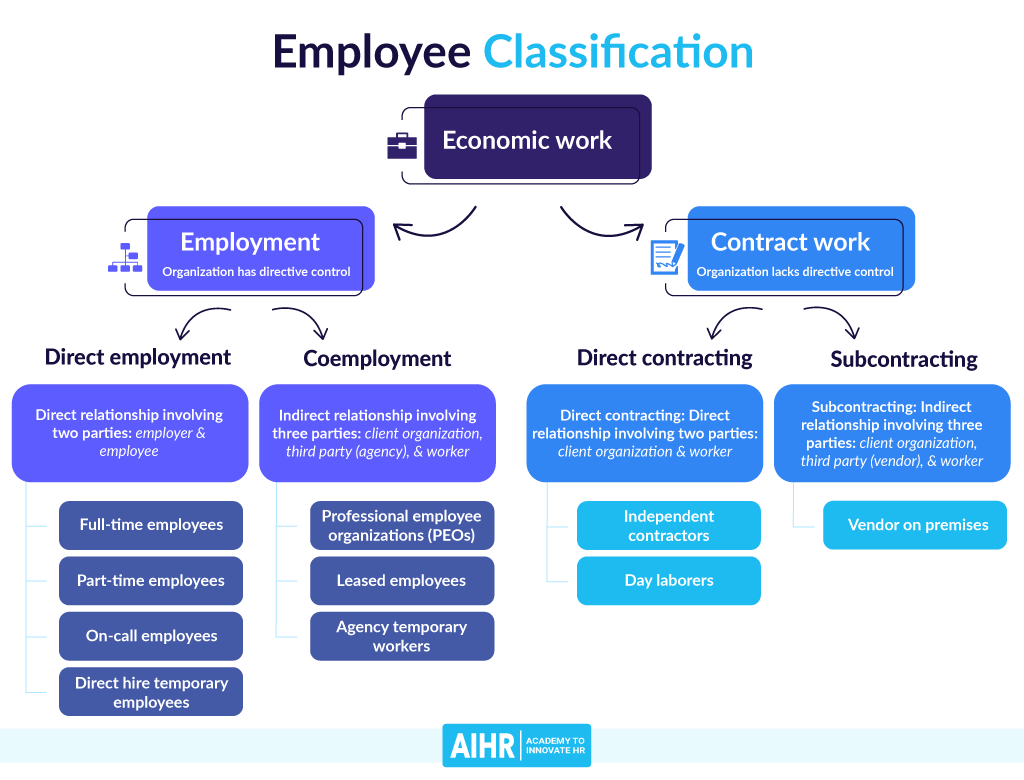

Below you can see what employee classification can look like in the new economy, divided between multiple types of employment and contract work.

Exempt employees vs non-exempt employees

While the employee classification policy is left at the mercy of employers, whether an employee is exempt or not is regulated by the Fair Labor Standards Act (FLSA). We won’t get into much detail about the rules, but we will summarize the definition of exempt and non-exempt employees. For more details, take a look at the FLSA website.

In short, an exempt employee is an individual who is exempt from the overtime provisions of the FLSA. That means that they are not entitled to overtime pay. Most exempt employees are salaried and can be classified as executive, professional, administrative, or outside sales employees.

Non-exempt employees are usually paid hourly and are entitled to overtime pay.

Of course, there are other differences to be considered, but if you are a business owner who has to deal with this type of employee classification, it’s best to ask for help from a specialist in labor law.

What are contingent workers?

Independent contractors, freelancers, consultants, or any other type of worker who is not hired via an employment contract is classified under contingent workers. These people are collaborators who can help with various projects and tasks, but they are also separate entities from your business.

When hiring the services of a contingent worker, you as the business owner don’t have to worry about benefits, providing them with health insurance, or any other actions that usually involve a traditional employee.

Remote workers vs independent contractors

By definition, remote workers are not present in the office or workplace. Instead, they do their tasks from a remote location (their home or somewhere else around the world).

Adoption of remote work (or work from home) has sped up during the pandemic. However, it’s also a product of the great technological development we’re experiencing in recent years.

Due to portable devices and various services that allow collaborative work between in-office and remote employees, companies nowadays have a global-wide talent pool at their disposal.

However, as a business owner, it’s essential to understand that remote workers are not necessarily contingent workers (or independent contractors).

You can have both employees who work remotely (full-time, part-time, or temporary) and remote workers who are independent contractors.

The difference is that the first type is classified as a traditional employee while the latter is a collaborator who works remotely and takes care of their own time management, devices, and taxes.

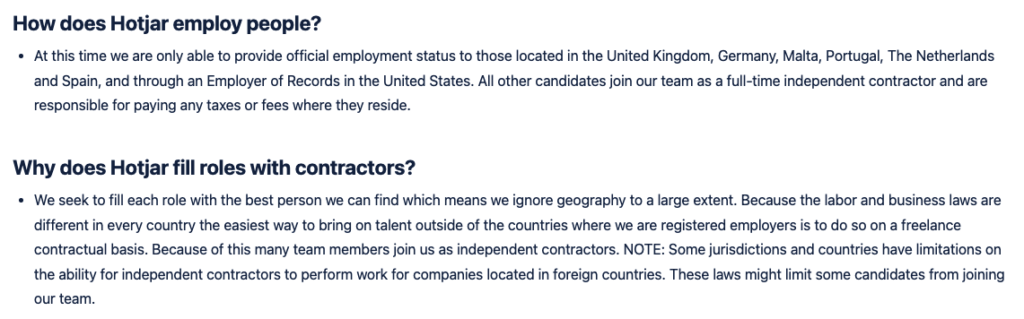

Many remote-first organizations hire people as independent contractors, as it is the easiest way to get people on board without needing to deal with different labor and business laws across different countries.

Other options are using the services of a professional employer organization (PEO) or working with an employer of record (EOR).

How to deal with a complex workforce

Having your workforce made up of different types of employees enables your business to be flexible and agile. You can respond to your business needs faster.

To achieve this, businesses must learn how to manage a workforce that includes remote and in-office workers, plus a few collaborators and maybe some leased employees.

First, it’s important to find better ways to invest in your current employees if you want to improve retention. However, you also need to learn how to attract gig workers and manage their time and tasks to benefit both parties.

Businesses will have to deal with this situation more and more in the future. Organizations that don’t adapt will eventually fail while the competition will strive. So, which side do you want to be on?

Weekly update

Stay up-to-date with the latest news, trends, and resources in HR

Learn more

Related articles

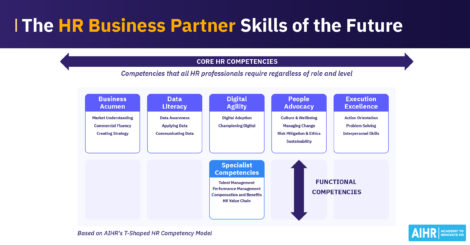

Are you ready for the future of HR?

Learn modern and relevant HR skills, online