Accrued Payroll

What is accrued payroll?

Accrued payroll refers to the wages, salaries, bonuses, commissions, and other forms of compensation earned by employees that still need to be paid by the company. This concept is a common aspect of accounting and financial reporting.

Why is accrued payroll important?

Accrued payroll is essential in accounting and business management as it represents salaries and wages earned but not yet paid to employees. It is a key aspect of accrual accounting, ensuring financial statements accurately reflect a company’s obligations and financial position.

Additionally, accurately managing accrued payroll is crucial for legal compliance, effective cash flow management, and informed decision-making regarding labor costs and business strategy. It plays a vital role in maintaining a company’s financial health and operational efficiency.

How do you record accrued payroll?

Accrued payroll is recorded by making an adjusting journal entry in the accounting records at the end of an accounting period. This involves debiting the payroll expense account, which reflects the company’s incurred expenses for employee services during the period, and crediting the accrued payroll liabilities account, indicating the amount owed to employees but not yet paid. This entry ensures that the expenses are recognized in the period they are incurred, aligning with the accrual basis of accounting.

HR tip

For effective accrued payroll record-keeping, update records each pay period, accurately track hours worked and accrued benefits, and regularly audit these records. Utilizing reliable payroll software can streamline this process, ensuring accuracy and compliance with labor laws.

Types of accrued payroll

Accrued payroll accounts for all types of employee remuneration, including:

1. Salary and wages

This is the most common type of accrued payroll. It includes the hourly wages of employees plus salaries for exempt workers. For hourly workers, this includes their hourly wage times the number of hours they are scheduled to work. For salaried employees, the obligation is a percentage of their total pay.

Example: An employee with an annual salary of $60,000 who is paid monthly accrues $5,000 in salary each month, regardless of whether the payroll is processed at the end of the month or later.

2. Overtime pay

Overtime pay accrues when employees work more than their standard working hours. The rate for overtime pay is usually higher than the normal pay rate.

Example: If an employee who earns $20 per hour works 45 hours in a week, they would accrue overtime pay for the extra 5 hours at a rate (often 1.5 times their standard rate), resulting in an additional $150 (5 hours x $30) in accrued payroll for that week.

3. Bonuses and commissions

These are typically performance-related types of pay. Bonuses are generally fixed amounts given to employees for achieving specific targets, while commissions are usually a percentage of sales made.

Example: A salesperson with a commission rate of 5% who makes sales worth $100,000 in a month accrues $5,000 in commissions for that month.

4. Holiday, vacation, and sick pay

These pay types accrue as employees earn time off based on company policies. This can include paid holidays, accrued vacation days, and sick leave.

Example: If an employee accrues one vacation day per month and earns $200 per day, they would accrue $200 in vacation pay each month.

5. Employee benefits

This includes health insurance costs, retirement plans, and other benefits employers promise to provide to their employees.

Example: An employer contributes $500 monthly to an employee’s health insurance plan. This amount is accrued monthly as part of the employee’s total compensation package.

6. Payroll taxes

These are taxes that employers are obligated to pay on behalf of their employees, such as social security and Medicare taxes in the United States. They are accrued as the corresponding wages are earned.

Example: If the payroll tax rate is 7.65% and an employee earns $1,000 in a pay period, the employer accrues $76.50 in payroll taxes for that period.

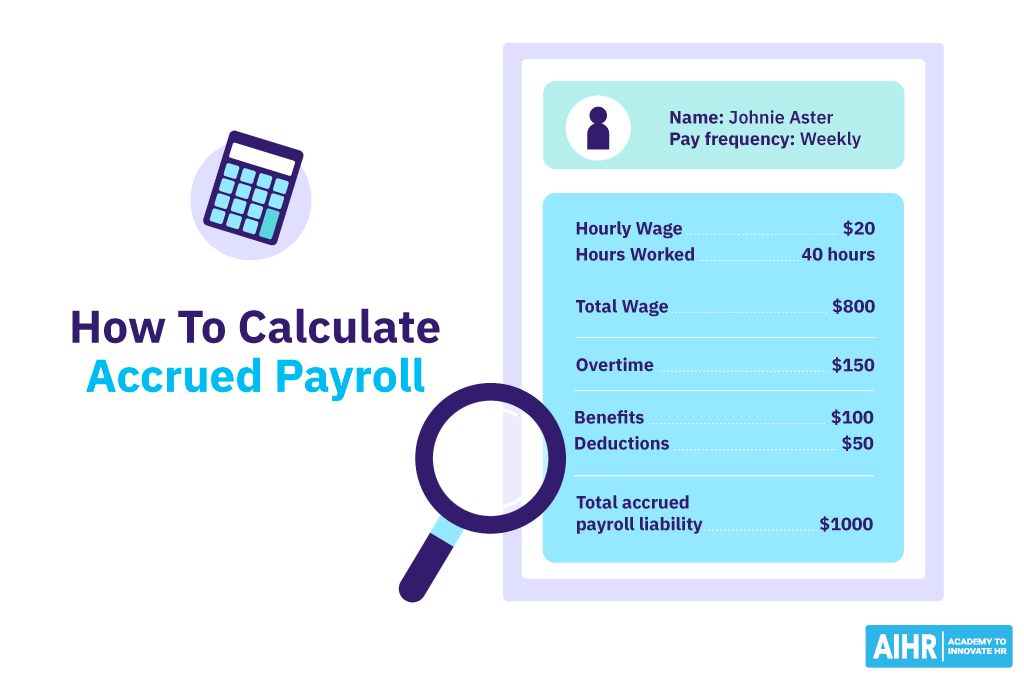

How to calculate accrued payroll

To calculate the accrued payroll cost for an employee, you typically consider factors such as the employee’s hourly wage, the number of hours worked, and any additional benefits or deductions that might apply. Here’s a basic example:

- Hourly wage: The employee is paid $20 per hour.

- Hours worked: The employee has worked 40 hours in a week.

- Overtime: Overtime is often paid at 1.5 times the hourly rate. The employee worked 5 hours of overtime.

- Benefits: The employee has benefits that cost the company $100 per week.

- Deductions: There might be deductions for things like taxes or retirement plans. The deductions total $50 for the week.

The formula to calculate the weekly payroll cost would be:

Total Payroll Cost = (Regular Hours × Hourly Wage) + (Overtime Hours × Overtime Rate) + Benefits − Deductions

Regular Pay = 40 hours × $20/hour = $800

Overtime Pay = 5 hours × ($20/hour * 1.5) = $150

Total Pay before Deductions = $800 (Regular Pay) + $150 (Overtime Pay) = $950

Total Payroll Cost = $950 (Total Pay) + $100 (Benefits) – $50 (Deductions) = $1,000

FAQ

Yes, accrued payroll is considered a current liability as it represents the amount of salary and wages that a company has incurred but has not yet paid out to its employees. Current liabilities are obligations that a business needs to settle within one year or within its regular operating cycle, whichever is longer.

Accrued payroll salary refers to the amount of money a company owes to its employees for work performed but not yet paid, recorded as a liability on the company’s balance sheet. This includes wages, salaries, and other forms of employee compensation for a specific pay period.

Accrued salary is both an expense and a liability. It is noted as an expense on the income statement, reflecting the cost of employee services used in a period. Simultaneously, it is also recorded as a liability on the balance sheet, representing the sum due to employees for these services yet to be paid.