Predictors of Job Performance: What Drives Insurance Sales Agents [Case Study]

Understanding predictors of job performance enables organizations to assess candidates for relevant characteristics and, ultimately, hire people who will help the company succeed. Drivers of performance differ per job and organization, and you need to pinpoint them correctly to create impact. Let’s have a look at how an organization assessed predictors of job performance of insurance sales agents.

Contents

Analyzing insurance sales agents’ performance

Overall findings

Recommendations

Analyzing insurance sales agents’ performance

A company operating in the insurance industry wanted to assess what drives the performance of sales agents in their business. It was a Zimbabwean insurance company with an overall staff of 680 at the time of the study. The workforce includes employees in two other regional countries. The sales agents assessed in this study were all based in Zimbabwe. The company’s operations in the two additional regional countries are relatively new and with a small staff.

The study aimed to get insights from the assessments to help the company increase its revenue. To determine what drives the performance of sales agents, we at the HR consultancy company IPC Consultants tested all the sales agents in this organization. We assessed 166 sales agents by giving them cognitive and personality tests. 51% of the employees were females, and 49% were males. For females, the average age was 30.52, and males had an average age of 31.6.

For female sales agents, work experience varied from 1 to 23 years, with a mean of 5.1 years and a median of 4 years. Males had an average of 3.8 years of work experience, with a median of 3 years and a range of 1 to 11 years.

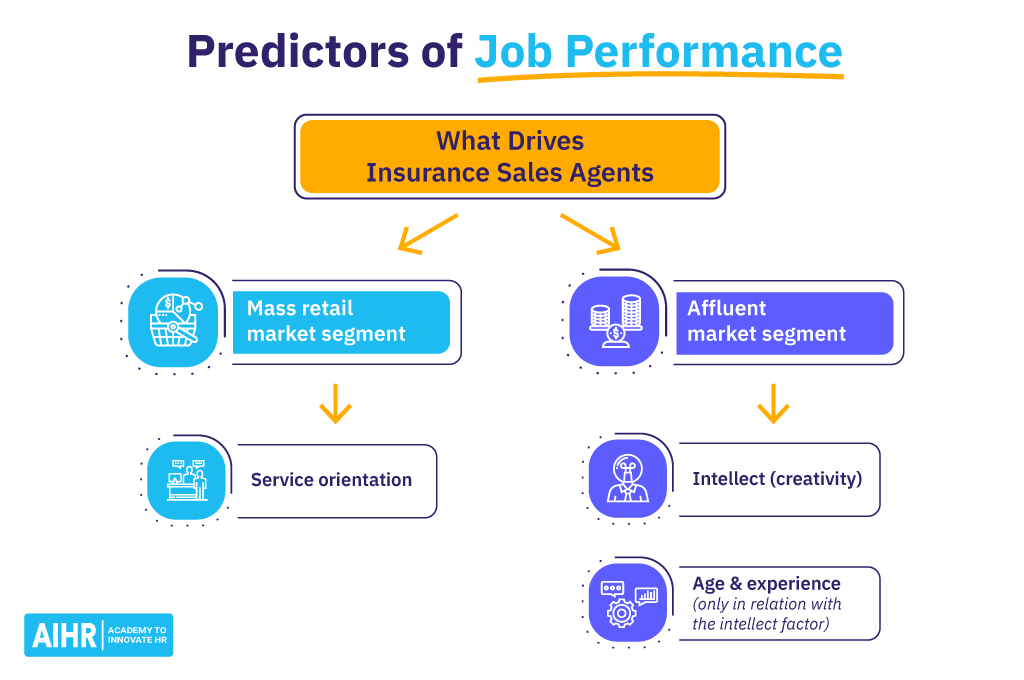

The sales agents were handling two segments of the market, namely the mass and affluent markets. In the mass market, the sales agents focused on low-income earners. In the affluent segment, the sales agents focused on selling products to high-income earners. Both categories of sales agents sold similar individual insurance products but to different market segments.

Predictors of performance

We administered cognitive ability tests to all sales agents. The sales agents took the abstract, numerical and verbal reasoning tests. These three tests put together are often referred to as general mental ability.

The personality questionnaire measured the following personality dimensions:

- service orientation,

- conscientiousness,

- intellect,

- ambition,

- extraversion,

- openness to experience,

- and adjustment.

Outcome variables

The outcome variables in this study were actual dollar sales, the number of policies sold, and the number of active accounts. We focused on active accounts and excluded the dormant accounts. When creating the composite measure incorporating the three outcome variables, we used z scores. We developed a composite measure of performance incorporating the three outcome variables, referred to as the job performance score.

Approach

We checked the reliability of all predictor variables. We recorded the highest reliabilities as expected in the cognitive ability tests compared to those for personality variables. None of the predictors had reliability below 0.6.

Using confirmatory factor analysis, we assessed the stability of the personality dimensions. We proceeded with the analysis once we found out that the personality traits met the minimum standards required in confirmatory factor analysis.

We analyzed the data using correlation and regression analysis.

Overall findings

When the data was analyzed, combining the sales agents from the mass and affluent markets, age and experience were related to job performance. This contradicts the already-known findings that show no significant relationship between age and job performance.

We found a negative relationship between the agent’s level of education and the number of active accounts.

Our findings show that the personality dimension of service orientation (popularly known as agreeableness in other personality assessments) contributes 57% to the job performance of the sales agents. This means that for every unit increase in service orientation, there is a 57% increase in the composite performance score of a sales agent. The personality trait of ambition to lead explains an additional 36% variance in sales agents’ performance. For every unit increase in ambition to lead, there is a 36% decline in performance, given the negative correlation between the ambition to lead and sales agents’ performance.

Education level and service orientation (non-confrontational) were negatively and positively related to active accounts, respectively. Higher education may lead to an arrogant attitude (“I know what is in your best interest”). Avoiding unnecessary arguments and conflict (“the customer is always right”) helps maintain active accounts.

When educational level and service orientation are regressed on active accounts, the educational level gets double the weight of service orientation (non-confrontational). This finding indicates that the educational level of sales representatives should be matched to the market’s overall level of education.

Findings: Mass market

We analyzed the performance of sales agents looking after the mass retail market on their own, and here’s what we’ve found.

The conscientiousness subfactor “hard effort” significantly negatively influenced performance, with females being more hardworking than males. Sales agents with high leadership ambition (personality trait) performed poorly on sales dollars and active accounts.

A comparison between the top and bottom performers {split at the median} in the mass retail market shows the following findings: The demographic variable “Experience in sales” and the personality trait “Service orientation” were positively related to the number of policies sold. Ambition {leadership dimension} and adjustment {stress dimension} were negatively related to the average number of policies sold.

For bottom performers, no variables under study were related to the three outcome variables in this study: sales dollars, number of policies sold, and number of active accounts.

Findings: Affluent market

The following emerged when we analyzed the retail sales agents handling the affluent market. The variables below had positive relationships with performance:

- experience

- intellect (ideas, thinking outside the box)

- ambition (leadership- taking on leadership roles)

- ambition (risk-taking calculated risk)

Ambition as a whole had a positive relationship with performance.

Correlations found in the study

Performance Experience Intellect – Ideas Ambition –

LeadershipAmbition –

RiskAmbition –

TotalPerformance 1 .406 * .493 * .428 * .405 * .475 * Experience .406 * 1 .055 .145 .051 .176 Intellect – Ideas .493 * .055 1 0.000 .413 * .242 Ambition –

Leadership.428 * .145 0.000 1 .354 .733 ** Ambition –

Risk.405 * .051 .413 * .354 1 .822 ** Ambition –

Total.475 * .176 .242 .733 ** .822 ** 1

**. Correlation is significant at the 0.01 level (2-tailed).

Under this affluent market, about 39% of performance is accounted for by experience and intellect (thinking outside the box). Age and experience had significant and positive relationships with performance.

Intellect (ideas, thinking outside the box) and age are positively related to the number of policies sold. Verbal reasoning, a facet of general mental ability, had the most significant negative relationship with active accounts. Verbal reasoning accounted for 23% of the variation in performance as measured by the number of active accounts.

A comparison between the top and bottom performers {split at the median} in the affluent market shows these findings: The only variable that predicts performance for the top performers is the ideas dimension of intellect. For the bottom performers, ambition {leadership dimension} had a high negative relationship with performance.

Recommendations

Mass retail

Organizations can benefit from hiring sales agents with high service orientation for the mass retail market. For this market segment, the selection of staff should match the educational level of the community served. The desire to take a leadership role (ambition) should be considered, as high levels of ambition tend to reduce performance. This trait should be in the moderate range for a sales agent to perform adequately.

Affluent market

Since personality is a stable trait that rarely changes, it would be helpful to hire sales agents servicing the affluent market based on intellect (creativity). Age and experience are both significant factors to take into account. However, these factors, on their own, without taking intellect into account, would not be adequate selection criteria. This is because many studies have found that age and experience have only a weak correlation to sales performance.

As the affluent market is sophisticated in needs and wants, it is essential to recruit staff from the same market with all three predictors in mind (i.e., intellect personality trait, age, and experience as a sales agent).

A final word

Analyzing predictors of job performance helps organizations improve their recruitment process and make sure that they select candidates with the characteristics needed to succeed in the role. It helps organizations focus on relevant predictors of performance instead of wasting resources focusing on characteristics that have little impact on employee and organizational performance.

While identifying performance predictors is costly for roles with fewer people, it will bring immense value for roles with many people doing the same work, such as retail sales associates, bank tellers, or customer care agents.

When you know what to look for in your candidates, you’re well on your way to building a high-performing workforce.

Weekly update

Stay up-to-date with the latest news, trends, and resources in HR

Learn more

Related articles

Are you ready for the future of HR?

Learn modern and relevant HR skills, online