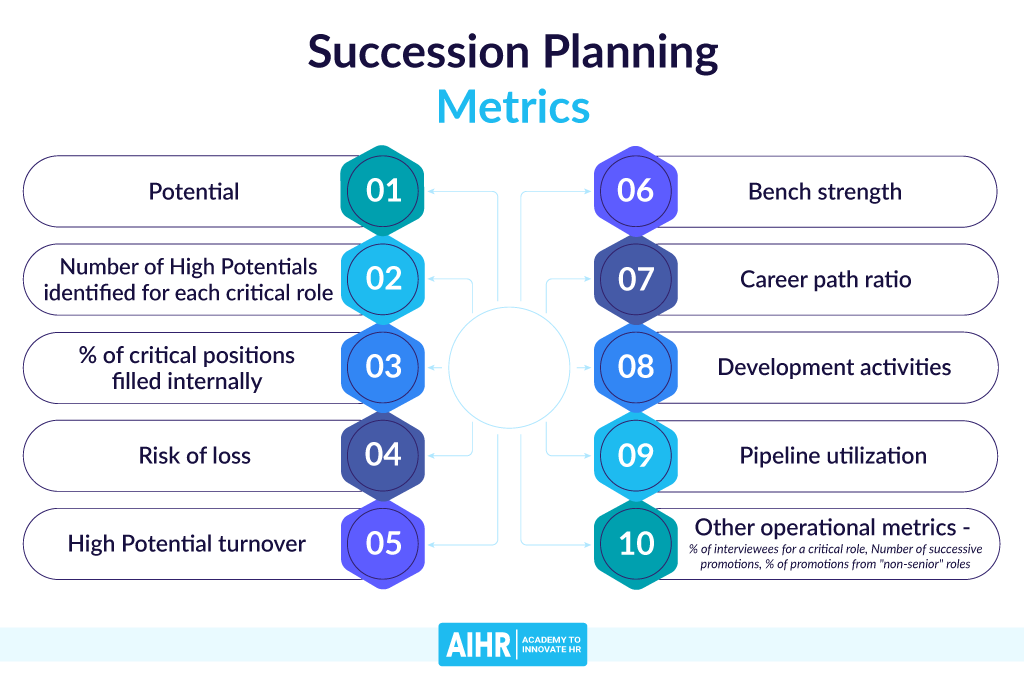

10 Succession Planning Metrics You Should Know

There are routine annual processes that organizations go through – strategic alignment, financial planning, employee satisfaction surveys, reporting, and many other vital processes – to keep the organization moving forward. However, the one that often gets neglected but is among the most important is succession planning. Tracking succession planning metrics helps you understand how you’re doing and what you need to do better.

Where an organization is going and its ability to execute its strategy largely depends on having the right talent and leaders in place at the right time and in the right role. Far too often, however, it’s clear that this is not always the case, as can be seen with some of the consequences of the Great Resignation. Indeed, while 86% of leaders believe succession planning is important or an urgent priority, only 14% believe they’re doing it well.

To add to the challenge, one of the emerging trends for 2022 is that the future of work is flexible and ambiguous. The world of work is unpredictable, so preparing for multiple futures is vital. Succession planning is thus an urgent need for any organization.

Let’s have a look at succession planning metrics your organization can learn a lot from.

Contents

How do you track succession planning?

Common succession planning metrics

1. Potential

2. Number of High Potentials (HiPos) identified for each critical role

3. % of critical positions filled internally

4. Risk of loss

5. High Potential turnover

6. Bench strength

7. Career path ratio

8. Development activities

9. Pipeline utilization

10. Other operational metrics

How do you track succession planning?

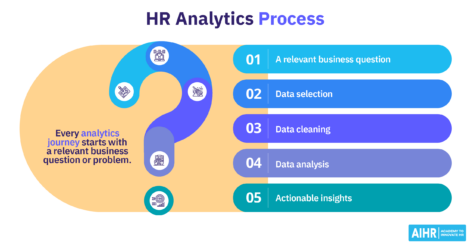

In short, succession planning is the process and strategy of identifying and developing talent to fill critical roles within the organization when needed. Typically, Human Resources professionals lead this process together with managers and senior leaders.

Measuring succession planning helps organizations ensure their succession planning works well and make improvements wherever needed.

There are two types of succession planning metrics. The best approach is to combine metrics from these two categories to get the most accurate picture of the state of succession planning at your organization.

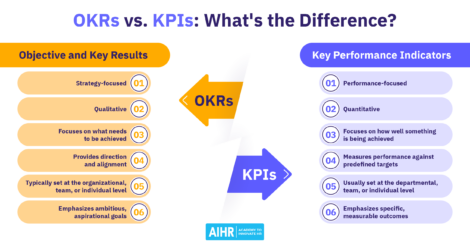

- Quantitative metrics – Numbers are the kind of metrics the board wants to hear. This includes numerical data, stats, charts, graphs, etc.

- Qualitative metrics – These metrics are more subjective but still provide valuable information. They include various types of feedback, analysis of open-ended comments, sentiment analysis, etc.

Common succession planning metrics

1. Potential

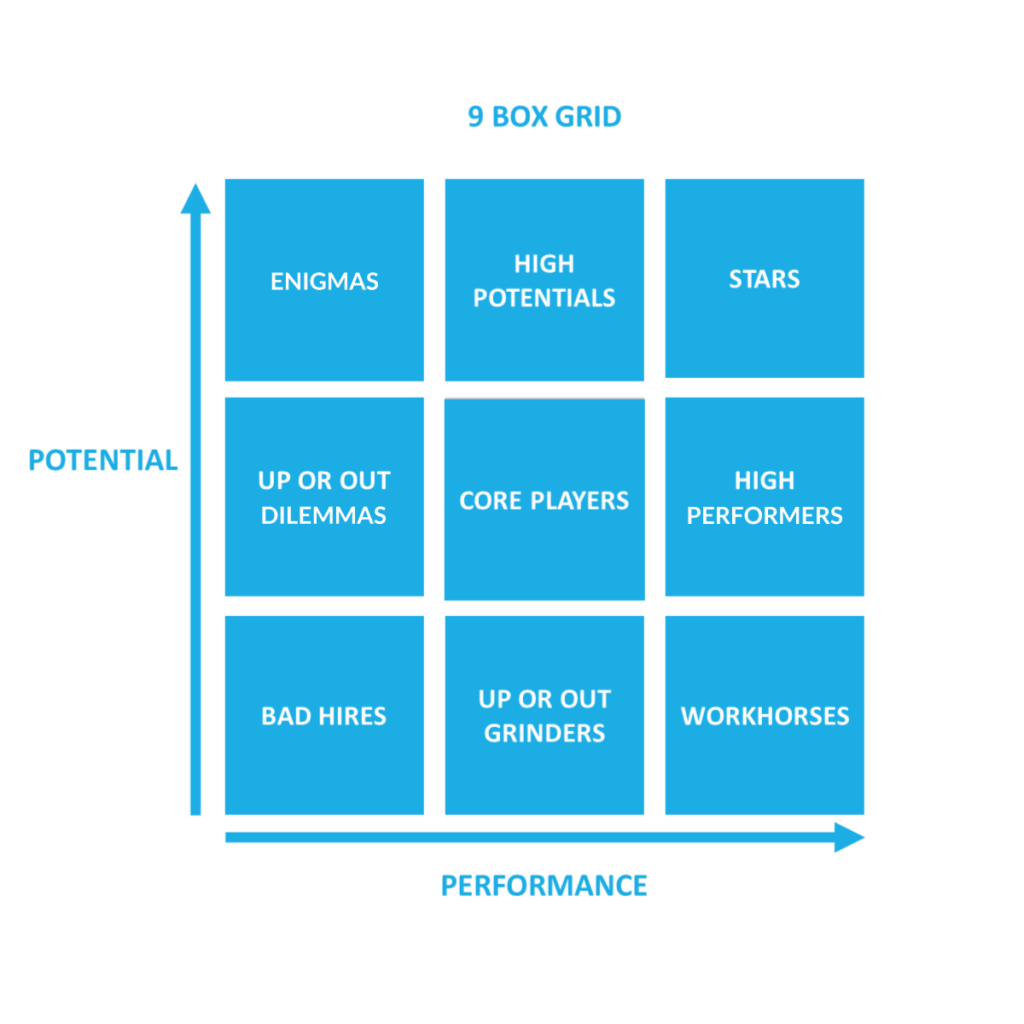

Employees with high potential have a combination of ability and motivation to succeed in senior positions in an organization. It’s vital that you as an organization retain, nurture, and develop these employees, and place them on your succession plan. To measure potential, you can use the 9-box grid:

Succession planning focuses on the two blocks in the top right-hand corner (Stars) and middle (High Performers). These are the employees who will build the future of your organization. To accurately plot your employees on this grid, you need to:

- Assess performance – To understand if performance is low, moderate, and high, you can collect this data through annual performance reviews, 360-degree feedback, quantitative data (e.g., sales, net promoter scores, etc.).

- Assess potential – This is how well an employee is likely to perform in the future (i.e., their growth potential). You can get this type of data from peers, managers, direct & indirect reports, and the leadership team. There is no mathematical formula to calculate an individual’s talent. That’s why understanding the qualitative feedback received from clients and peers is essential. Employees assessed as “Stars” are the high priority for succession planning.

2. Number of High Potentials (HiPos) identified for each critical role

If an organization’s most valuable asset is its people, then a High Potential (HiPo) is exceptionally valuable. A HiPo has a combination of aspiration, engagement, and ability:

- Aspiration is the willingness and drive to move to more senior roles and leadership positions. You can measure this through personality profiles and speaking to employees about their aspirations.

- Ability is the capability to be effective in more senior roles. This can be measured through performance and various projects/assignments.

- Engagement refers to the willingness to remain committed and engaged with the organization. You can measure engagement through various surveys and qualitative data received during discussions between the employee and the manager.

Once you identify these individuals, you want to match them to critical roles. You want to have at least two successors for each critical role, who ideally are HiPo employees. Of course, you would need to first identify your organization’s critical roles. Critical roles are roles that are of high importance to business operations or have a unique skill set or knowledge base and will impact the organization in the next 5 – 10 years.

3. % of critical positions filled internally

The percentage of critical roles filled internally will measure your ability to develop internal talent and if your succession plan is actually working. You can compare this to percent (%) of critical roles filled with external candidates. You can do the same for management positions.

This is a great way to measure your organization’s ‘bench strength’ and whether or not your succession planning place is solid. You can get this data from your internal recruitment measures. The percentage of critical roles from outside will tell you if your employer branding and external hiring strategy is strong enough to support your succession plan. Again, you can extract this data from your recruitment stats.

4. Risk of loss

This metric is also called “flight risk”. How likely is it that a particular (high potential) employee leaves in the next X months? Now, there’s no way to measure flight risk precisely because that would literally be reading into the future. But there are measures that provide indicators of when a high potential employee might leave.

- HiPos that are paid below the market – Sooner or later, a competitor will try and poach your HiPo, and they are likely to leave if they are paid below the market. To understand if they are paid below the market, you can conduct a compensation analysis, compare the results internally and use external benchmarks as well.

- Change of role – If a HiPo recently changed a role that does not align with their goals or aspirations, they are more likely to leave. The options for a HiPo are not limited, so they are likely to seek something new if their needs aren’t being met. You can measure the level of satisfaction during one-on-one conversations with managers and in annual surveys as well.

- Big life change – If there has been a sudden loss of a significant person, or they are forced to relocate to another state or country, there is a big chance they might resign. A proactive organization looks at what they can do in these moments to offset resignation and be as accommodating as possible.

It is also possible to measure flight risk through various models, and it requires time and the proper inputs to ensure accuracy.

5. High potential turnover

It is a tell-tale sign that if the turnover of high potentials is increasing, the organization’s succession planning is failing. It’s an indicator of the efforts to retain high potential employees.

To calculate high potential turnover, divide the number of HiPos who left by the number of HiPos in the organization. The turnover rates will quantitatively indicate if it is of concern or not (you can measure if it is above average compared to the rest of the workforce in the organization). Exit interviews of HiPos are also an effective way to understand why they left and what your organization could have done better to keep them.

6. Bench strength

Bench strength refers to an organization’s ability to fill critical positions internally. A common way to evaluate bench strength is to look at the percentage of (high potential) employees or managers that you’ve identified as ready for promotion. Divide the headcount ready for promotion by total HiPo/management headcount to get your result.

But how do you know when an employee is ready for promotion? Here are a couple of things to consider:

- Capacity – Always asking for more work.

- Complexity – Already doing parts of a job of a higher role.

- Performance – Results are consistent and at a high level.

- Resourcefulness – They are seen as a source of knowledge and a reference point.

7. Career path ratio

This measures the employee growth rate through the number of promotions, both lateral and vertical. To calculate the career path ratio, divide the total number of promotions (upward) in the organization by all role changes (both lateral and upwards). Here is how to interpret the results:

- 0.7 – signals frequent promotions

- 0.2 – signals that there might be an issue with the promotion process and little movement within the organization.

A succession plan is not only to promote the top high-potential employees but everyone along the way. So, good movement, both lateral and upwards, is vital.

8. Development activities

Another set of metrics to track is the tools and development activities that support effective succession planning. Some of the measures under this include:

- Learning & development activity – Peruse your LMS to understand how much learning activity has taken place with your HiPos and potential successors. Understand if the learning activities by those marked to fill key positions are happening.

- Development plan – Understand if every person marked as a successor has a (leadership) development plan that helps them develop the competencies and expertise they need to transition to a more senior role.

- Management support of talent development – As part of every manager’s goals, developing key talent and successors should be a principal objective.

- Quality of information – Understanding the effectiveness of information capture, both in performance feedback systems and through annual talent development conversations.

9. Pipeline utilization

The percentage of time an employee from a succession plan is used to fill a vacant role (either a critical role or a management position). This is the test of whether succession planning is just done as a tick box exercise or if it is actually being used to make decisions.

You can calculate this by dividing the number of employees from the succession plan promoted / number of employees promoted to a vacant role.

10. Other operational metrics

There are other clear indicators of whether or not a succession plan is in operation in an organization.

- % of interviewees for a critical role – Ideally, 100% of candidates interviewing for a critical role should be part of the succession plan. These are employees who should have had a stretch assignment or opportunities to develop themselves before interviewing for the position.

- The number of successive promotions – The % of employees that are marked as key/critical and how many times they have been promoted within a three-year cycle.

- % of promotions from “non-senior” roles – Your succession plan considers not only employees in management positions but also junior positions or those without long tenure. This means that the organization is keeping an eye on star talent at any given stage of the employment cycle.

Over to you

When measuring the state of succession planning at your organization, you need to choose the relevant metrics. As we’ve already said, the board will care about different numbers than the talent management team. So select your metrics with care, gather and analyze data regularly and make data-driven decisions based on the results. That way, you’re ensuring that the succession planning process at your company is as effective as possible.

Weekly update

Stay up-to-date with the latest news, trends, and resources in HR

Learn more

Related articles

Are you ready for the future of HR?

Learn modern and relevant HR skills, online