Pre-Tax Deductions

What are pre-tax deductions?

Pre-tax deductions are any amount of money subtracted from an employee’s gross wages before taxes are withheld. Since these deductions are withheld before the wages are taxed, they lower the taxable income and any money an employee might owe to the government.

It may also reduce taxes under the Federal Insurance Contributions Act (FICA) – such as Social Security and Medicare (hospital insurance tax) – and employer-paid contributions like State Unemployment Insurance (SUI) arrears, Federal Unemployment Tax (FUTA), and FICA. Among these, the statutory deductions include FICA taxes, federal income tax, and state and local taxes.

How do pre-tax deductions work?

Understanding how pre-tax deductions work not only helps to ensure the payroll is in order, but also enables HR to better answer employee questions about their remuneration.

Some common questions employees may ask HR include:

1. Do pre-tax deductions reduce taxable income?

Yes. As the name suggests, pre-tax deductions are taken directly from an employee’s total pay before the employer withholds taxes. Because these deductions are made before settling income tax, it lowers the employee’s taxable income and other taxes under the FICA, such as Medicare and Social Security.

The federal government changes pre-tax deductions yearly based on inflation and the cost of living. These adjustments hugely impact the taxable income to be withheld.

On the contrary, post-tax deductions don’t reduce an employee’s income tax because their pay will be taxed before the deductions are withheld from their salary.

2. What are the types of pre-tax deductions?

Several employee benefits are eligible for pre-tax deductions. They include:

- Health insurance: In some circumstances, employer-sponsored health insurance, such as medical and dental benefits, Health Savings Accounts (HASs), and Flexible Spending Accounts (FSAs), may qualify as pre-tax deductions.

- Life insurance: Monthly premiums for life insurance coverage are often withheld as pre-tax deductions. Some coverage policies are even exempted from taxes. For example, group-term insurance contributions are exempted from taxes up to a specific coverage limit per employee, usually $50,000.

- Retirement funds: Any contribution a staff member contributes as a financial retirement-planning strategy – such as a 401(K) plan – is often deducted from the employee’s gross pay before income taxes are paid.

- Transportation benefits: These are employee benefits that go into a company-sponsored account to cater to the employee’s transportation costs to and from work or parking fees. In most cases, these are classified as pre-tax deductions.

3. How do pre-tax deductions affect take-home pay?

Pre-tax deductions lower taxable income because they are subtracted from an employee’s gross salary before taxes are withheld. This approach benefits the employee, i.e., they’ll take home a higher net pay than they would otherwise have if the deductions were made after taxes.

Pre-tax vs. post-tax deductions

A company withholds pre-tax deductions from an employee’s paycheck before withholding taxes. As such, it lowers the employee’s and employer’s tax liabilities, at least for the time being.

If the employee uses the pre-tax benefits in the future, they might have to pay taxes. For example, a member of staff contributing to the 401(K) retirement plan may be exempted from paying taxes while working, but they will owe taxes once they withdraw the fund when retiring.

Post-tax deductions, however, are withheld from an employee’s payable income after all their tax liabilities are covered. Therefore, after-tax deductions do not affect taxable income.

Unlike before-tax deductions, post-tax subtractions increase tax liabilities for both the employer and employee, but eventually, the latter won’t owe taxes when using the benefits in the future. For instance, an employee won’t have to pay taxes if they withdraw a retirement fund they used to contribute after their income tax is withheld.

Some common types of after-tax deductions include:

- Disability insurance

- Wage garnishments

- Some retirement plans, such as the Roth IRA retirement plan

- Charitable donations

Benefits of pre-tax deductions

The benefits of pre-tax deductions come in different forms, but the primary ones include the following:

- Lowers taxable income

- Reduces FICA taxes (Social Security and Medicare)

- Increases employee confidence in knowing the needs that matter most are covered

- Lowers an employee’s tax burden

Pre-tax deduction list

The federal government amends the regulations governing pre-tax deductions every year. It’s crucial to obtain up-to-date information on after-tax deductions before implementing payroll changes.

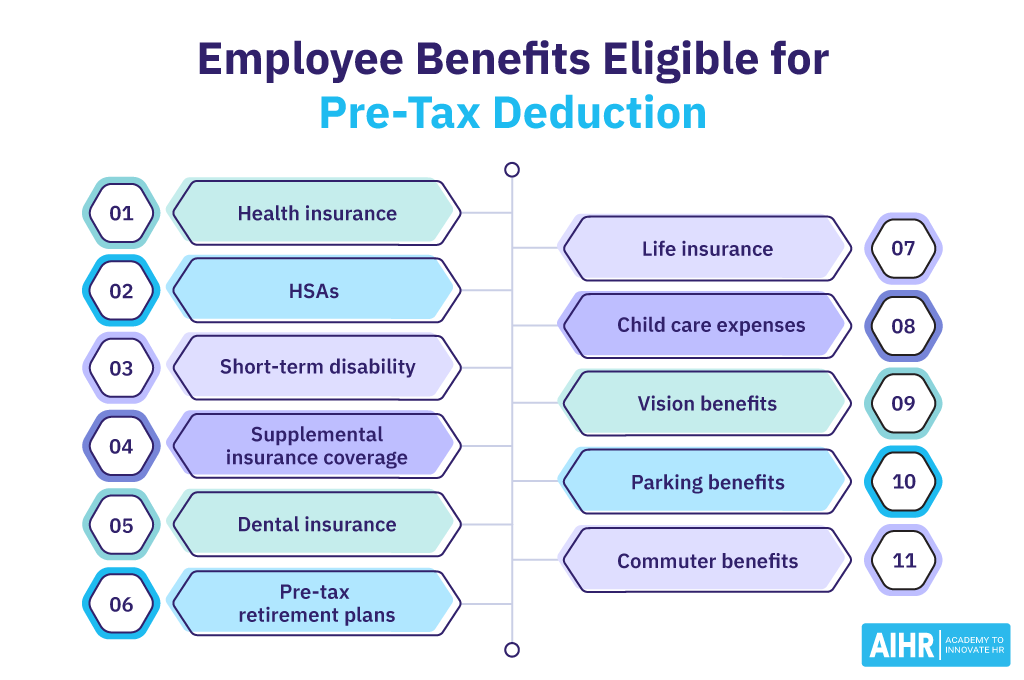

The following is a list of employee benefits that currently qualify as before-tax deductions:

- Health insurance

- HSAs

- Short-term disability

- Supplemental insurance coverage

- Dental Insurance

- Pre-tax retirement plans

- Life insurance

- Child care expenses

- Vision benefits

- Parking benefits

- Commuter benefits.

Pre-tax deductions examples

Example 1:

Suppose you have an employee with a pre-tax deduction of $70, and you pay them $1,500 per biweekly pay period.

You first need to take away their pre-tax withholding amount from their total pay – $1,500:

$1,500 – $70 = $1,430

The remainder is the employee’s taxable income, which means taxes will be withheld for $1,450 instead of $1,500.

Example 2:

An employee may contribute $100 per month to an employer-sponsored commuter fund to cover their daily commutes, such as train tickets or bus passes. If the employee receives a monthly salary of $4,200, then the commuter benefit contribution will be deducted before taxing their income:

$4,200 – $100 = $4,100

Therefore, the employer will withhold taxes for $4,100, not $4,200.