The Compensation and Benefits Manager – A Full Guide

The compensation and benefits manager plays a key role in coordinating the corporate compensation and benefits department. In this article, we take a closer look at this role. We dive into the core responsibilities of the compensation and benefits manager and take a look at his/her salary.

Table of content

What is the compensation and benefits manager?

Compensation and benefits manager job description

How to become a compensation and benefits manager

Compensation and benefits manager salary

FAQ

What is the compensation and benefits manager?

A compensation and benefits manager is responsible for ensuring fair and accurate compensation, including regular salaries, bonuses, stock options, pensions, and any additional types of employee benefits. In bigger companies, this may be an entire department, in which case the C&B manager coordinates all compensation and benefits efforts, while in a smaller one it may be just one of the duties of an HR Generalist.

Compensation and benefits manager job description

The compensation and benefits manager works with hiring managers, recruiters, and other Human Resources personnel to ensure that job offers are both based on market rate and have internal equity (an explanation is provided below). Here are some of the tasks that a Compensation and Benefits Manager has responsibility for.

Determining Market Rates. C&B managers must evaluate every position and determine the proper market value for that job. They often do this through salary surveys and statistical analysis to determine what the market value is for each job.

Because each company is different and jobs can vary from person to person, this is not always a fixed number. Job requirements such as education, years of experience needed, and specific schools can help set a base number. Then, when determining an offer for a specific person, the C&B manager must consider their actual education, years of experience, number of people supervised, and particular duties.

For instance, a company may advertise a position as a marketing manager, but the best candidate has ten years of experience and has ideas that the company wants to implement. The market rate for that candidate would be higher than the planned salary, so a C&B manager would adjust the salary.

Building Pay Bands. Because the value of a job varies based on who does the work (as not everyone has the same skills), many companies have salary bands. These salary ranges have a mid-point, which is considered the market rate for the position. Your relationship to this midpoint is called a compa-ratio.

Evaluating Jobs. In addition to a specific salary, each job sits within a pay band. A C&B manager will assess the job description for each position and assign it to a job band based on specific criteria. Several jobs across the company can all be assigned to the same job band, even though the duties and responsibilities are different.

Job titles are also often tied to these job bands so that a Junior Analyst is a Grade 8, and an Analyst is a Grade 10, and a Senior Analyst is a Grade 12.

Monitoring Internal Equity & Analytics. Everything is negotiable, but a C&B manager needs to ensure that the pay is equitable internally. Excellent negotiation skills should not result in a substantially different salary for peers that are similarly situated. C&B managers check not only the internal equity of people with the same job title, but look across the organization, taking special note for differences in race, gender, and age. Frequently they will use regression analysis to make sure there are grounds for variances. Experience and education are valid reasons for one person to earn more than another, as are performance appraisals and hours worked, but gender and race are not legitimate reasons.

In addition, compensation and benefits data is usually the best maintained and most structured kind of people data. This makes it highly suitable for people analytics. The aforementioned compa-ratios can be compared to performance metrics. Ideally, high performers have a positive compa-ratio, average performers are at the mid-point, while bad performers have a negative compa-ratio. Deviations can indicate bad compensation practices.

Also, deviations from compa-ratios can be compared between different pockets in the organization to identify deviations. These can also indicate potential structural problems when it comes to rewarding. Identifying these trends early and correcting them is a key part of the compensation and benefits manager role.

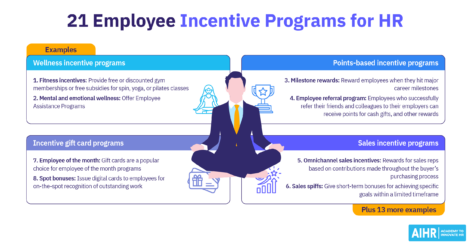

Building Bonus Structures. There are two types of bonuses: Discretionary and non-discretionary.

A non-discretionary bonus includes guaranteed production bonuses and sales bonuses. The company sets the amount (or percentage) before the employee does the work. If the employees meet the conditions, they receive the bonus.

A discretionary bonus can vary based on numerous factors, including company and personal performance. C&B managers develop these structures, again working to ensure market criteria and internal equity.

Retirement plans. Both fixed contribution plans (such as 401ks) and fixed distribution plans (such as pensions) fall under the responsibilities of a C&B manager. They work with vendors, employee councils, unions, and attorneys to create and manage these plans.

Health insurance. In the United States, health insurance is often tied to your employment. The company determines which health insurance plans and negotiates costs with insurance companies, usually working through a health insurance broker. This is also the responsibility of a C&B manager.

All other benefits. From yoga at lunch to snacks in the breakroom, to the number of vacation days, the C&B manager plays a crucial role in determining these benefits for employees.

Benefits software. An often-forgotten aspect of compensation and benefits is managing the relevant HR software. Increasingly, organizations are deploying flexible compensation and benefits structures. An expat may want a few more days off to visit family home, while a single dad may have more benefits of company-sponsored childcare. Being able to tailor benefits packages to individual demands can have a highly positive impact on employee morale and motivation. Software is a key enabler in this.

How to become a compensation and benefits manager

If you would like to be a compensation and benefits manager, you’ll generally need a bachelor’s or master’s degree in business or HR and several years of experience in Human Resources. You will need a strong background in finance and statistical analysis, as these are critical when working with salary.

Strong candidates should have compensation certifications that demonstrate an understanding of the field. Certifications include Certified Employee Benefits Specialist, Compensation Management Specialists, or Certified Compensation Professional. Broader Human Resources Certifications, such as those offered by the Society for Human Resources Management (SHRM), the HR Certification Institute (HRCI), and certain online HR courses can provide general knowledge of compensation and benefits but are not as specialized as the previous certifications are.

Compensation and Benefits Manager Salary (USA)

Salaries will vary depending on specific duties, company size, and location. A C&B manager in Iowa would expect a median salary of $112,560 per year, according to Salary.com, while one in Washington, DC, would expect $79,017.

In larger companies, you may have director-level employees who supervise others and command much higher salaries. A Compensation Director in Washington, DC, has an average salary of $166,651 per year – more than double that of a manager-level role. And, of course, all of these duties can fall under an HR generalist in a smaller company.

One thing is for sure – a good candidate for a compensation and benefits manager job should be confident in the salary she asks for, or she’s not very good at her job.

FAQ

A compensation and benefits manager is responsible for ensuring fair and accurate compensation, including regular salaries, bonuses, stock options, pensions, and any additional benefits.

If you want to be a compensation and benefits manager, you’ll generally need a bachelor’s or master’s degree in business or HR and several years of experience in Human Resources. You will also need a strong background in finance and statistical analysis.

Salaries will vary depending on specific duties, company size, and location. A C&B manager in Iowa, for instance, would expect a median salary of $64,560 per year, according to Glassdoor, while one in Washington, DC, would expect $79,017.

Weekly update

Stay up-to-date with the latest news, trends, and resources in HR

Learn more

Related articles

Are you ready for the future of HR?

Learn modern and relevant HR skills, online