HR Finance 101: A Guide To Finance for HR

HR finance is an overlap of the HR and finance departments in a modern organization. While traditionally HR and finance are two completely different departments with their own responsibilities, financial awareness has become a critical requirement for HR professionals in most modern businesses.

The main responsibility of finance is to allocate and monitor resources that support the goals of the organization while ensuring a balance between revenue and costs. On the other hand, HR is responsible for recruiting, motivating, and managing the people who advance those goals. It has become necessary for HR and finance departments to collaborate to advance the company’s goals.

Contents

Why does HR need to know finance?

How HR can utilize financial information

The foundations of finance for HR

Why does HR need to know finance?

Labor costs like salaries, benefits, and related taxes make up as much as 70% of total operating costs of a business. That’s why in most companies, planning and budgeting begins with HR.

HR professionals need to be knowledgeable about preparing and managing the budgets of all departments in the company. Financial awareness is a critical requirement for HR professionals in most modern businesses. They need to understand finance and accounting to make a difference as strategic partners in the planning and management of a large organization.

Aside from helping in the budgeting of costs, HR is also responsible for ensuring the achievement of the budget. Solid knowledge of finance for HR is a key requirement for every role in the HR department of every modern organization.

It is also noteworthy that as companies increasingly invest in integrated business processes such as ERP, every department is expected to understand and be able to communicate financial information to one another. HR plays an important role in creating value in the company in making decisions on hiring and training staff. Finance for HR is critical to ensuring that the department’s decisions comply with set rules and regulations and will add value to the company’s overall goals and objectives.

Another reason HR must be knowledgeable about their organization’s finances is to attract top talent. Potential hires today are pretty smart and carry out due diligence about a company before deciding to join them. When meeting with HR regarding potential hiring, the best talent in the market may insist on scrutinizing a company’s financial reports to see how they stack up against the competition.

How HR can use financial information

The decisions HR makes daily can either promote or impede the organization’s financial performance. Recent research by management and consulting firm McKinsey found that organizations with HR that make decisions fast and efficiently are twice as likely to record as much as 20% higher financial returns. Here are ways HR can use financial information to make better decisions.

- Improving financial strategy: HR needs to understand the factors that drive costs and revenue in their organization. This will help them make decisions that promote the company’s overall goals and objectives. HR departments that make better decisions are an invaluable strategic business partner that helps the organization reach its outcomes more efficiently.

- Creating value across the organization: A company fares better when HR and finance are collaborating effectively. When both departments are working together, the organization, in general, will better maximize returns on its people. For instance, HR can partner with finance to create a working hiring model that factors in scenarios such as the company’s forecasted growth and optimizing the costs of recruitment and training.

- Carrying out resource analysis: An organization’s financial statements come in handy when analyzing and interpreting its financial health. HR can make more informed decisions on how and where to allocate resources and what strategies work best to advance the organization toward its goals.

- Estimating the financial impact of projects: To effectively manage a company’s human resources, HR must decide which projects and initiatives are worth the investment and which are not. HR can use cost and revenue data from finance to calculate the ROIs of these projects to estimate profits even before the company starts or completes a project.

The foundations of finance for HR

HR managers and staff must understand the basics of finance early on and build on them throughout their careers.

Basic financial terms HR should know

Here are the basic financial terms HR should know:

1. Debit and credit

Debits and credits are terms that refer to transactions entered in a double-entry system of accounting. A debit is an entry that increases the value of an asset or expense in an account or decreases the value of equity or liability. A credit increases a liability or equity or decreases the value of an asset or expense in an account. A debit is entered on the left side of the ledger, while a credit is entered on the right.

For example, when a business purchases a new asset worth $1,000 on credit, the amount would be entered as a debit in the equipment (asset) account and a credit in the accounts payable (liability) account.

2. Transaction

A transaction is a business event with a financial impact on an organization’s financial statement. A transaction is entered into an accounting record, typically in the ledger. For example, when a company pays a wage for a service rendered, the amount is recorded in the wages payable account of the balance sheet.

3. Account

An account is a record in the financial ledger that is used to store, categorize, and sort transactions. For example, most companies have a Cash account that is used to record all transactions that increase or decrease the company’s cash monetary value.

4. Asset

The term asset refers to anything with current or future economic value owned by a company. Examples of assets are investments, tools, equipment, machinery, and patents.

5. Liability

A liability is an organization’s obligation to pay money to individuals or other organizations, now or in the future. In other words, a liability is a debt owed to a person or another company. A business does not make money from liabilities. Examples of liabilities are bank debts, taxes owed, and money owed to suppliers.

6. Owner’s equity

Also referred to as shareholder’s equity, owner’s equity is the amount of money that would be given to the owner or shareholders if all the company’s assets were liquidated and all debts paid off. Examples of owner’s equity include common and preferred stock, retained earnings, and additional paid-in capital.

7. Revenue

Revenue is the total amount of income that a business generates from its primary operations. Some examples of revenue are rent, dividend, interest, and contra revenue from sales returns and sales discounts.

8. Expense

An expense is an operational cost that a company must pay to earn business revenue. It refers to the outflow of cash in return for incoming goods or services. Examples of expenses are rent, utilities, wages, insurance, and costs of goods sold.

9. Cash flow

Cash flow refers to the amount of cash that comes into and leaves a business within a specified period of time. Cash received represents money coming in, while cash spent represents money going out.

10. Liquidity

Liquidity refers to how easily a business can meet its financial obligations with its assets. In finance, liquidity typically refers to how much cash the business has and how quickly it can convert its assets or security into cash without impacting its market price.

11. Working capital

The working capital of a business is the amount of money available to meet its current short-term obligations. In accounting, working capital is the difference between current assets and liabilities. For example, if a business has $1,000 in the bank and $500 in cash, and pending accounts totaling $400, its working capital would be $1,100.

12. Human capital

Human capital refers to the economic value that a person or group brings to an organization. It covers their training, skills, knowledge, health, motivation, and loyalty. Examples of human capital include communication skills, creativity, experience, and problem-solving skills.

Understanding and interpreting financial statements

HR needs to understand and be able to interpret the financial statements of the organization. There is a case to argue that HR professionals must be effective business persons first and human resource managers or leaders second. This is because these professionals need to understand the financial metrics that drive costs and revenue in an organization and all the factors that influence them.

With an in-depth understanding of financial statements, HR will better recognize the links between their decisions and the organization’s financial results. This knowledge will help them become valued contributors and trusted advisors to the organization’s decision-makers and owners.

Among the core responsibilities of an HR professional is to maximize the effectiveness of an organization’s human resources. Experience in interpreting financial statements and analyzing their organization’s financial position would go a long way to helping them make decisions that increase cash flow and cut costs.

Besides, understanding financial statements is also useful in analyzing human capital value and making the right outsourcing decisions. Finance in HR can prove invaluable in helping improve the workforce to improve the organization’s efficiency, performance, and overall bottom line.

Understanding the income statement

An income statement is a financial statement used to report a company’s financial performance over a specific period. It highlights the revenue and expenses used to calculate gains and losses over a certain period.

Understanding the income statement is critical for HR as it enables them to understand how well the business performs. It also makes it possible to scrutinize areas where HR can add value to boost the company’s performance.

Understanding the balance sheet

The balance sheet is a financial document that provides a snapshot of a company’s financial position at a specified time. The document highlights the company’s assets and sources of capital, including equity and liabilities. However, the balance sheet does not provide details about the company’s cash flow or revenue.

HR can use the balance sheet to better understand the company’s financial health at a specific point in time. They can use this information to plan for the company’s short-term resource needs and allocations and to make hiring and firing decisions.

Understanding the cash flow statement

The cash flow statement provides a summary of all the cash and cash equivalents entering and leaving the company. The statement includes aggregate data of cash received from the company’s operations and any external investments and cash paid out for business activities and investments over a certain period.

A cash flow statement is an important tool that HR must review consistently to get crucial insights into the company’s financial health. They can also use this statement to identify potential and emerging problems in resource allocation and get insights on how to avert or resolve them.

Understanding costing for HR

Costing is a system used to assign costs to elements of a business. In finance, costing is used to develop costs for staff, customers, products, distribution channels, processes, product lines, and even entire branches.

There are four types of costs: fixed, variable, direct, and indirect costs. In HR, costing considers the outlay or material cost and the time cost. Another consideration is the sum of the fixed, variable, and opportunity costs.

HR professionals use costing to evaluate the spending of each business department and their overall impact on business goals. For example, HR can use costing to understand the company’s expenses line by line in income and cash flow statements and highlight areas where they can cut costs.

Understanding budgeting for HR

Budgeting is a financial process of creating a plan of how a business should spend its money. The spending plan is referred to as a budget. Creating a spending plan enables the company to estimate how much money it will need to run its operations vis-à-vis how much they expect to earn.

Understanding the budget is critical to helping HR create a resource stability plan. The department can better estimate and allocate resources based on anticipated costs and revenue. It also helps HR understand company-wide staffing needs to prevent over-hiring and under-hiring.

From the HR perspective, budgeting helps the department project the number of staff the company requires or can afford, project benefits and salary costs, and estimate projected turnover rates and costs.

Financial HR metrics to consider

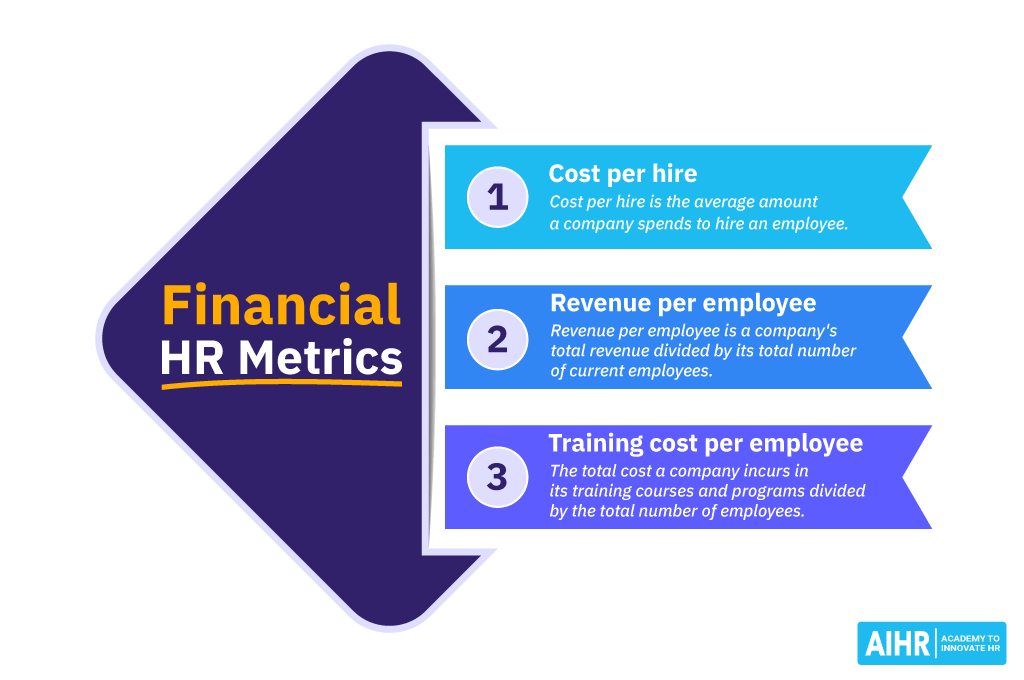

Here are 3 finance HR metrics that, when used effectively, can play a role in a company’s success.

1. Cost per hire

Cost per hire is the average amount a company spends to hire an employee. This is a critical metric when creating or tracking the costs of recruiting staff. For example, when a company plans to hire 10 people and budgets to spend $5,000, the cost per hire is $500.

2. Revenue per employee

Revenue per employee is a company’s total revenue divided by its total number of current employees. This is an important ratio that HR can use to measure how much money each employee generates for the company.

3. Training cost per employee

This is the total cost a company incurs in its training courses and programs divided by the total number of employees. The budgeted training costs of employees can impact staff turnover and maximize productivity.

Wrapping up

Both HR and finance aim to advance the objectives of the organization. Therefore, HR needs to know about finance. Since HR’s main responsibilities incur costs and generate revenue, directly or indirectly, there is a lot for the organization to benefit from when HR knows as much as they should about finance.

Weekly update

Stay up-to-date with the latest news, trends, and resources in HR

Learn more

Related articles

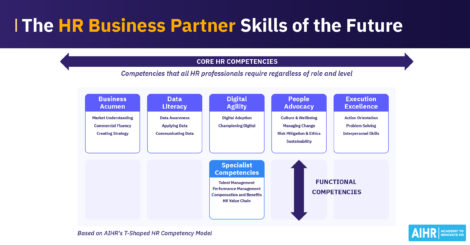

Are you ready for the future of HR?

Learn modern and relevant HR skills, online