How HR Can Manage Rising Inflation: 8 Scenarios

With US and EU inflation at a four-decade high, both employees and leaders are looking to HR to set policies on how to deal with the rising cost of living. In this article, we provide a practical guide on how to deal with rising inflation.

Contents

How inflation impacts pay

When to take action (and make pay adjustments)

Dealing with (hyper)inflation

Communicate clearly and continuously

How inflation impacts pay

Let’s start with the basics. Pay does not follow inflation. Most organizations base their budget on the cost of labor and not on inflation. The cost of labor is influenced by supply and demand – the labor market is historically tight – as well as location and is mapped through salary surveys.

To show you the difference, US inflation in July 2022 was 8.5% year-over-year. Still, companies are budgeting an overall average increase of 4.0% in 2022 and 4.1% in 2023, according to a Willis Towers Watson survey. This means that wages are rising slower than the cost of living.

In countries experiencing consistent rising inflation over many years, it is common to include a cost of living adjustment (COLA) as part of the remuneration cycle. This is granted at the employer’s discretion and is not tied to performance. Here, the purpose is not to increase the employee’s purchasing power but rather to maintain current levels in response to rising goods and services.

Granting a COLA is dependent on affordability for the organization and has a significant impact on the flexibility of the remuneration composition. COLAs, in general, are also not a long-term solution. Very often, without the right controls in place, year-on-year COLAs result in many employees moving beyond designated pay bands.

The biggest risk for organizations at the moment is making decisions that will influence the viability of their compensation strategy in the longer term. Not only could this significantly impact the sustainability of the organization but also have a detrimental impact on employee engagement and employability.

When to take action (and make pay adjustments)

There are no fixed rules on when to make pay adjustments. This will depend on the nature of work, industry, and culture of the organization. Below, we will provide a couple of scenarios and propose solutions to the scenarios. Based on relevance to your organization, you can apply these actions accordingly.

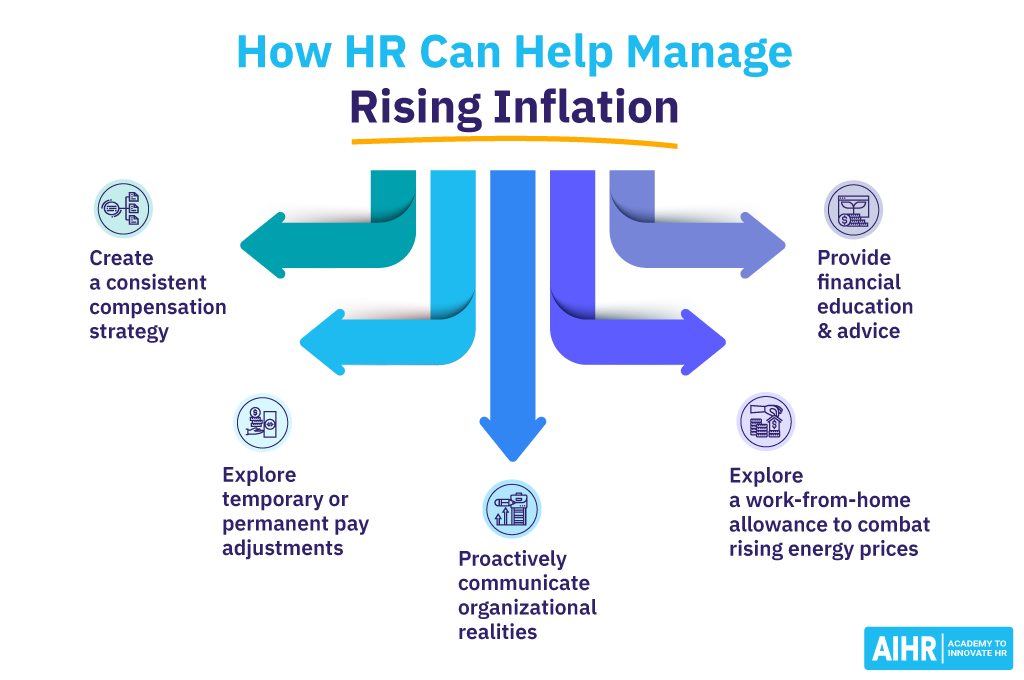

Scenario 1: “We don’t have a formal compensation strategy”

| Response | Actions |

| In this case, your first step is to create a consistent and clear remuneration approach. At a minimum, decide on how to deal with the rising cost of living for the entire working population and consider potential interventions for minimum wage employees. Some employers decide to segment their employee population (e.g., all employees, critical need jobs only, or employees in lower job levels) and implement different interventions for these groups. There is no right or wrong, but do create a clear (internal) compensation policy for the rising cost of living with guidelines that you can consistently apply over time. | 1. Create a consistent compensation strategy 2. Segment the workforce to identify specific needs and requirements 3. Validate the long-term viability of the approach 4. Align the leadership team on the approach |

Scenario 2: “We have minimum wage employees”

| Response | Actions |

| Employees working at minimum wages will struggle the most with inflation. Providing them with a pay adjustment may be a good starting point. This can either be done across the board or for specific types of roles, either as a one-time bonus or through structural salary increases. | 1. Identify low-wage roles 2. Explore temporary or permanent pay adjustments 3. Align your desired action with your broader remuneration cycle and process |

Scenario 3: “Employees ask for inflation-based adjustments of salaries”

| Response | Actions |

| Proactive, transparent communication will be key here. How pay is determined is often not well understood by employees. Explain that very few companies apply inflation-based adjustment and that your company follows the cost of labor and will index salaries accordingly. It is important to provide other forms of support, either through financial advice or benefits guidance, for employees to optimize their current remuneration package. For example, an employer might allow employees to flex their contribution towards their pension plans to ensure more cash flow. Again, this has to be done based on the right financial advice. | 1. Proactively communicate organizational realities 2. Offer alternatives 3. Continuously listen to employee concerns |

Scenario 4: “Employees complain that salaries are increasing at a rate lower than inflation”

| Response | Actions |

| You can often see comments along these lines: “They offer a 5% increase now, and 2.5% on January 1st. This is not enough. Inflation was 8.5%, and increasing salaries with less is, in fact, a salary reduction”. Although this comment may not be wrong, it is a common misconception that salaries will always increase with inflation. This showcases the importance of communication. A cost of labor correction lower than inflation is good practice as automatic wage increases based on inflation may, in turn, drive further inflation in a vicious circle, referred to as wage-price spiral. | Educate employees on your remuneration approach |

Scenario 5: “Employees complain their buying power is a lot lower and they are out of pocket”

| Response | Actions |

| In this instance, it would be wise to review your current remuneration package mix. By flexing certain benefits and contributions from both the employer and employee perspective, it is often possible to increase the cash component for the short-term without impacting the longer-term ability to build wealth. An example of this would be temporarily lowering the pensionable salary, which would result in increased net pay for the employee. | Revisit benefit and pay composition |

Scenario 6: “Gas prices are rising”

| Response | Actions |

| One of the common problems in the European Union is steeply rising gas prices. Especially for remote and hybrid work, spending more time at home can significantly impact what employees need to pay for gas. Including this in a work-from-home allowance (especially during winter) is a great and unique benefit. | 1. Explore hybrid work options 2. Explore a work-from-home allowance |

Scenario 7: “Rise in garnishments and requests for salary advances”

| Response | Actions |

| Proactive financial assistance and advice can help employees reduce debt and also provide them with alternative means to structure and organize their finances. During this time, monitoring rising garnishments and salary advance requests is good practice to better understand the financial wellbeing of your employees. This is a sensitive issue, and organizations need to deal with it in a confidential and supporting manner. | 1. Monitor garnishments and salary advance requests 2. Provide proactive financial education and advice |

Scenario 8: “People openly report difficulty managing financially”

| Response | Actions |

| This requires a case-by-case approach while also respecting the dignity of the employee. However, it is not uncommon. Two-thirds of US households are living paycheck to paycheck, making it the most common financial lifestyle in the US. In Italy, 72% of employees either just about get by or find it (very) difficult to manage financially. When your employees struggle financially, first see that they are compensated fairly. If so, help build their financial acumen through training or financial coaching. This should be part of any organization’s total wellbeing offering, as relatively simple interventions can make a big difference for those who are struggling. Specifically, help employees restructure debt and, by engaging with registered financial advisors, explore other options to increase short-term cash flow and longer-term wealth. | Provide financial advice as part of a wellbeing program |

Dealing with (hyper)inflation

Countries like Argentina, Zimbabwe, Turkey, and Iran are facing inflation rates of over 30% annually. If you have workers operating in these countries, you have a unique challenge at hand.

For these situations, we propose a specific set of interventions:

- Regularly review salary budgets. At the beginning of the year, you should adjust the budget for salaries for the cost of labor. However, this may be difficult to predict and track, and inflation may greatly increase over time. In these cases, it is also not unusual to use inflation rates (Consumer Price Index – CPI) as a guide and give multiple salary adjustments throughout the year.

- Be careful with permanent increases. High inflation may exaggerate existing salary differences. Adjusting pay on a regular basis to ensure a living wage without holding on too tightly to a percentage increase will provide both junior and senior employees with pay security.

- Agility in compensation decisions. When operating in a high-inflation country, you must have the agility to monitor the impact of unexpected inflation changes and adjust appropriately. In Argentina, it is not uncommon to update salaries up to four times a year for (expatriated) workers.

- Including a foreign currency. Paying salaries in a foreign currency offers another potential solution, but that may mean additional conversion fees for employees. You could potentially offer to pay part of the salary in a different currency as an optional benefit. We wouldn’t recommend paying the full salary in foreign currency.

These interventions are the exceptions and apply only to countries with inflation above a 25-30% threshold. They do offer some interesting lessons for organizations battling lower (but still substantial) inflation levels.

Communicate clearly and continuously

Clear, consistent, and continuous communication is key to managing compensation and benefits in times of high inflation. Increasingly, workers are striking over pay, including 115,000 British postal workers and the London tube strikes involving 40,000 Network Rail workers. These are leading to disruption and massive losses in revenue.

There are successful attempts to unionize at Starbucks and Amazon in the US, as well as a looming strike of 350,000 UPS employees.

These examples show the importance of (internal) communication around pay. You need to engage early and often with employees, involve them in decision-making, and make long-term agreements with buy-in from the relevant employee stakeholder groups.

Over to you

In 1974, President Ford declared inflation “enemy number one” and introduced the Whip Inflation Now program (abbreviated WIN).

In today’s economy, HR should have another WIN strategy. Its main components will be a clear strategy for compensation in an era of higher inflation, knowing how to answer common questions related to inflation, and taking the appropriate actions to help those who are in need.

Trust between employers and employees is an essential ingredient for success, and it has never been as important for a healthy and mutually beneficial employment relationship. By utilizing the actions mentioned in this article, you will be able to communicate and engage with employees on the right course of action for your context.

Weekly update

Stay up-to-date with the latest news, trends, and resources in HR

Learn more

Related articles

Are you ready for the future of HR?

Learn modern and relevant HR skills, online